- Moving the markets

After last week’s pullback, today’s session had the major indexes hovering slightly below their unchanged lines right after the opening, when suddenly at mid-day the floodgates opened and equities went into freefall mode. Of course, the reason was not that individual investors all of a sudden decided to sell, but the more likely was catalyst that the computer algos played ping-pong and pushed equities south. Besides, we’ve come way too far too fast in terms of past year’s rally that a correction was way overdue.

As ZH reports, in terms of records, this was the biggest drop for the S&P 500 since August 2011 and the 410-day record streak without a 5% correction is over. Nasdaq is over 7% off its highs; Dow & S&P are over 8% off their highs. The VIX exploded to reach 37, which is quite a jump from the lows of just above 9 back in November.

One of the causes of the increased volatility has been the spike in interest rates since last September. Today, the 10-year yield jumped again touching 2.84% intra-day but pulled back to close down 7 basis points to end at 2.77%. Again, bucking the trend was the US Dollar (UUP), which has been in a bear market for the past year, but managed to bounce higher by +0.43%.

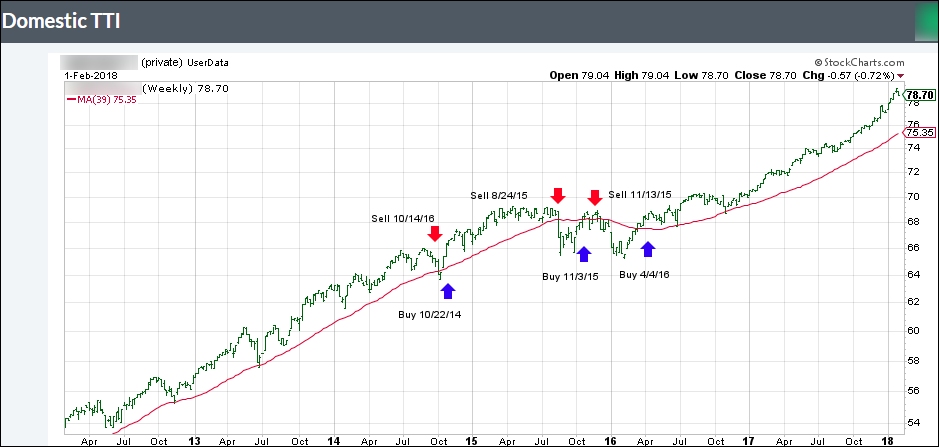

Our Trend Tracking Indexes (TTIs) remain on the bullish side of their respective trend lines (see section 3 below) but several of our trailing sell stops were triggered for some of our holdings and will be liquidated tomorrow. That is, unless a rebound rally is in the making in which case I will hold off another day.