ETF Tracker StatSheet

https://theetfbully.com/2018/02/weekly-statsheet-etf-tracker-newsletter-updated-02-15-2018/

COMEBACK WEEK

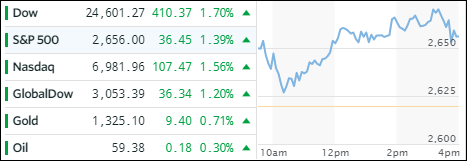

[Chart courtesy of MarketWatch.com]- Moving the markets

A solid mid-day rally hit the skids, as news from Special Counsel Mueller’s indictment of 13 Russian nationals and three Russian entities, accusing them of interfering with the US elections, flashed on computer screens around the world. The major indexes dove, briefly slipped into the red but recovered to close around their unchanged lines. Nevertheless, it was a crazy comeback-week in the markets (S&P 500 +4.3%), which ZH summarized like this:

- Nasdaq, S&P – best week since Dec 2011

- Dow – best week since Nov 2016

- Small Caps – best week since Dec 2016

- “Most Shorted” Stocks – biggest weekly short-squeeze since Nov 2016

- VIX – biggest weekly drop since Nov 2016

- US Treasury Yield Curve – 2nd biggest weekly flattening since Sept 2011

- HYG (HY Bond ETF) – best week since Feb 2016 (despite record outflows)

- Dollar Index – 2nd worst week in 6 months

- Gold – best week since April 2016

Giving equities an assist this week was a jump in bullish sentiment numbers and signs that the economy is growing but not yet overheating as had been feared. The 10-year bond yield seemed to support that view, if only for the time being, by slipping 3 basis points to end at +2.87%. At least the race towards the 3% mark has been halted.

The US Dollar Index (UUP) did its best imitation of a swan dive during the past 5 trading sessions thereby pushing all commodities higher. However, today UUP managed to bounce back +0.69%.

Budget deficits have been a non-addressed issue for a long time. Now, that the debt ceiling has been postponed for 2 years, we will see larger negative numbers for years to come. For some insight and the consequences, please see Simon Black’s excellent article.