ETF Tracker StatSheet

WHEN FOMO REPLACES FEAR

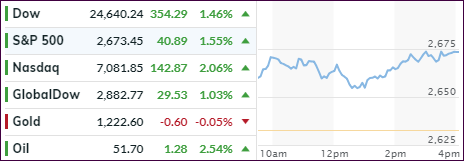

[Chart courtesy of MarketWatch.com]- Moving the markets

The computer algos had a field day and drove the markets higher based on the assumption that “something could maybe possibly happen” when Trump and Xi meet for dinner this weekend. That sparked a buying panic based on FOMO (Fear Of Missing Out), which put the fear factor that nothing might happen on the back burner. Thanks to the dovish Fed, the major indexes ended the week in the green, thereby recovering all the losses of the Thanksgiving week meltdown and ending the month slightly on a positive note.

The S&P 500 and Nasdaq had their best week in about 7 years but, as I have always said, and as history has shown, some of the biggest market recoveries happen while we’re stuck in bear market territory.

Much of this week’s activity was based on speculation whether the Fed “blinked” by bringing back lower interest rates and bond yields. Right now, it looks that way as the widely followed 10-year bond yield dropped the most in more than a year. It tumbled over 14 basis points in a month to end November at 3.02%.

For sure, that’s what stoked markets over the past week and, if this trend continues, the bulls may very well take the upper hand again. If an assist is thrown via a positive outcome from Trump’s dinner with Xi, and that is still a big uncertainty, we may find ourselves back in domestic equities very soon. Any defusing of trade tensions will get the bullish juices flowing, as we’ve seen in the past, but especially if a verifiable deal is made, we will be off to the races.

We will know more by Monday morning.