- Moving the markets

The much-anticipated Fed minutes (from their January meeting) showed that officials were divided on future interest rate hikes. One side argued that an increase might only be needed if inflation would exceed their baseline forecast. The other side thought it would be appropriate to hike later this year, if the economy behaves as expected.

Fed officials admitted that their U-turn on policy in December, which pulled the markets out of the doldrums, was necessary due to a more uncertain economic outlook and a tightening of financial conditions.

There was nothing earthshaking in these revelations, so the major indexes see-sawed around their respective unchanged lines but were able to maintain their upward bias by closing fractionally in the green.

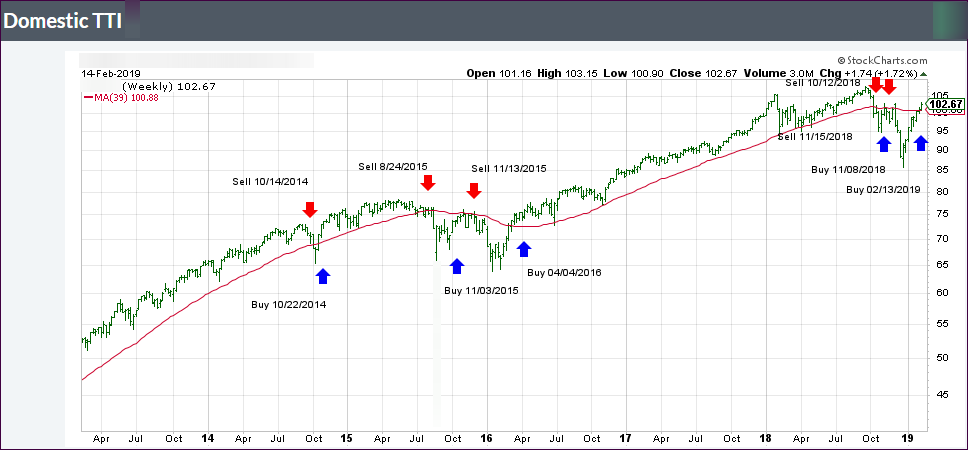

Technically speaking, the S&P 500 faces major overhead resistance at the 2,800 level, which has also been called a quadruple top. It may take some serious effort and several attempts, supported by “awesome” headline news, to break through this glass ceiling.

Our Trend Tracking Indexes (TTIs) remain in bullish territory with the International one now having established itself firmly above its trend line thereby generating a new ‘Buy’ for “broadly diversified international ETFs.” Please see section 3 below for details.