- Moving the markets

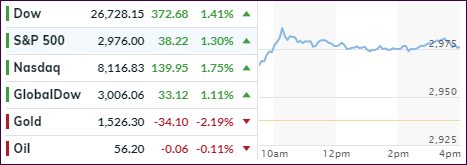

Throughout the session, the major indexes hovered below their respective unchanged lines, as US-China trade news offered a mixed picture, while a look ahead to the upcoming central bank policy meetings kept traders on edge.

Except for a last-minute spike in equities, interest rates kept a lid on advances with the 10-year bond yield rising over 8 basis points to end the day at 1.73%, which is quite a rebound considering that just recently we breached the 1.5% level to the downside.

These are huge moves, as the bond bloodbath continues, so it comes as no surprise that the victims over the past few days have been bond prices, as well as the low volatility ETFs (SPLV and USMV), which have been surrendering some of their superior gains. For context, 10-year yields are up 5 days in a row, gaining an amazing 24 basis points, which is the biggest jump since Trump’s election in 2016.

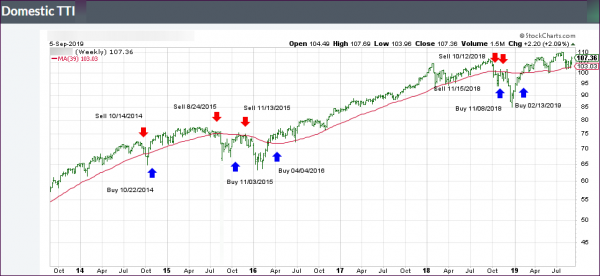

There seems to be a global re-shuffling of assets going on, as the unwind has pushed cyclicals higher and defensives lower with Transportations and SmallCaps suddenly surging, while the Nasdaq tumbled most of the day, but it was pushed to almost even at the close.

ZH reports that the most shorted stocks went on a rampage by soaring this week and actually registering the biggest 5-day short squeeze since the beginning of this year.

It was a rollercoaster kind of day, and I would not be surprised to see the Volatility Index (VIX) make a move again, as Fed policy uncertainty has hit record highs.

Read More