- Moving the markets

It came as no surprise that market sentiment took one on the chin, after Saturday’s drone attack on Saudi oil processing plants, which took about 5% of worldwide production offline.

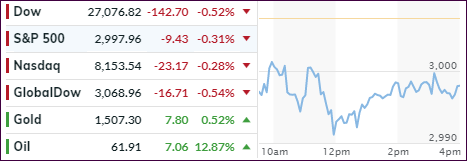

While the major indexes retreated, it was a modest haircut considering the recent advances. Oil prices spiked about 13%, down from an earlier 20%, but if they keep rising and a dose of inflation sets in, we will see more of a negative effect on stocks, or specifically the broad S&P 500 index.

On one hand a hefty surge in oil prices will most likely weigh on the index due to the negative impact on consumer behavior. On the other hand, the positives, at least temporarily, could be higher profits in the energy sector, along with employment to that region. We simply need to have more time pass to see which of the possibilities will materialize.

One analyst opined that “we could start expecting a negative impact from oil on the S&P 500 in an $80-85 range for WTI,” which means we have a long way to go from the current $61 level.

Bond yields acted as a safety haven with the 10-year dropping over 5 basis points to settle at 1.845%, while the oil volatility index surged to its highest since late 2018.

So far, the effect on equities was minor, and we’ll have to wait and see how this movie plays out.

Read More