- Moving the market

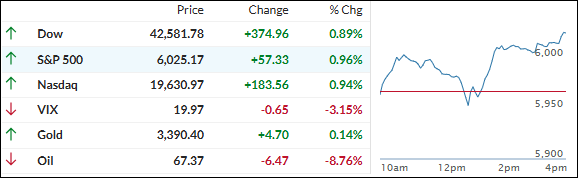

Despite the U.S. stepping into the Israel-Iran conflict over the weekend and bombing three nuclear sites, Wall Street opened higher and kept its cool.

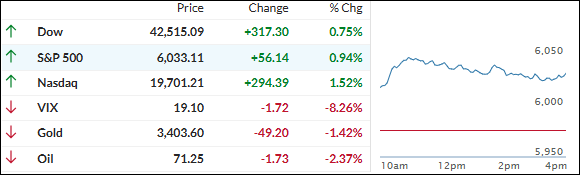

Traders were caught off guard by the strikes, especially after Trump’s Friday comments suggested a diplomatic route was still on the table. But with oil prices dropping instead of spiking, the feared “oil shock” never showed up—giving stocks room to climb.

That said, the situation is far from settled. The potential for retaliation is real, and even talk of closing the Strait of Hormuz hasn’t rattled markets—yet.

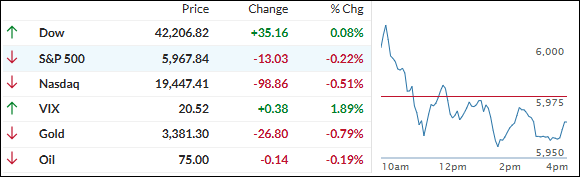

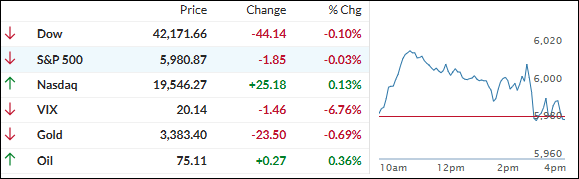

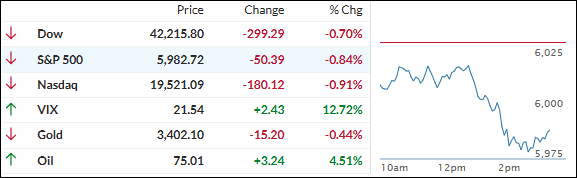

Midday, the early optimism faded, and the indexes briefly dipped into the red. But the pullback didn’t last. Stocks rebounded sharply, even after Iran launched strikes on U.S. bases in Iraq and Qatar. Traders largely brushed it off as political theater, and the market surged into the close.

Crude oil plunged more than 13% from its morning highs, echoing Wall Street’s “let it go” attitude. Tesla gave the Mag7 a boost with a strong move following the buzz around its Robotaxi launch.

Elsewhere, bond yields dropped early but recovered a bit by the close. The dollar started strong but reversed course, while gold held its gains. Bitcoin, after dipping below $100K over the weekend, bounced back to $103K.

With mixed signals from the Fed and global trade uncertainty still in the air, the market seems to be looking for a new catalyst.

So, the big question is: What’s going to be the next spark to drive stocks toward new highs?

Read More