- Moving the market

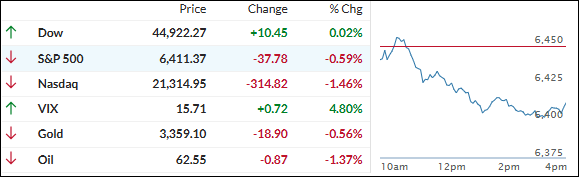

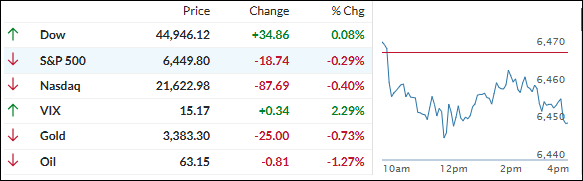

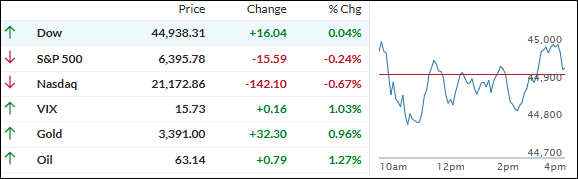

Wall Street got off to a rocky start today, with major indexes slipping again. Tech stocks took a hit for the second straight day, dragging the market lower as traders kept a close eye on mixed retail earnings and anticipated the latest word from the Federal Reserve.

Investors kept cashing out of big-name tech and chip stocks, worried about whether those high price tags—and the AI frenzy backing them—have maybe gone a bit too far.

Nvidia slumped around 3%, while AMD and Broadcom lost more than 3.5%. Over in software and semis, Palantir slid 5.5% and Intel dropped over 6%. Even the mega-cap crew—Apple, Amazon, Alphabet, and Meta—couldn’t find any traction.

On the retail front, Target’s stock tanked over 8% (the S&P 500’s biggest loser of the day) after reporting yet another sales drop and announcing a new CEO starting Feb. 1. Lowe’s, on the other hand, got a little love when its earnings beat estimates.

While traders scooped up some classic retail favorites, no one wanted to touch the so-called “Mag7” tech heavyweights, sending that group sharply lower. Despite the tech slump, the overall market stayed relatively steady.

Bond yields edged down, the dollar pulled back, and gold caught a bid—rising 1% as dip buyers swooped in. Bitcoin bounced back above $114,000 after taking a beating lately, suggesting it might have hit bottom.

But you could almost forget all that—because at the end of the day, everyone’s just waiting to see what Fed Chair Powell will say after Friday’s big symposium in Wyoming.

Read More