ETF Tracker StatSheet

You can view the latest version here.

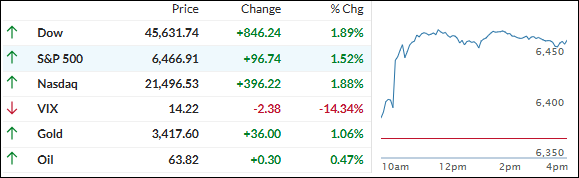

DOW HITS RECORD AFTER POWELL OPENS DOOR TO SEPTEMBER RATE CUT

- Moving the market

Today’s stock market breathed a sigh of relief after a tough week, led by a sharp rally sparked by Fed Chair Jerome Powell’s speech at Jackson Hole.

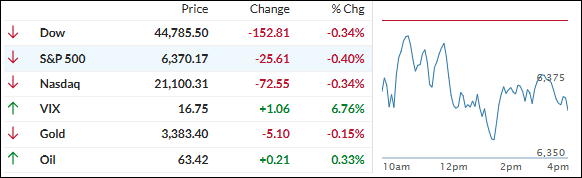

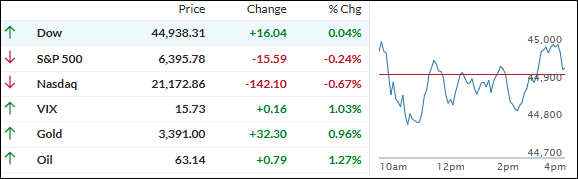

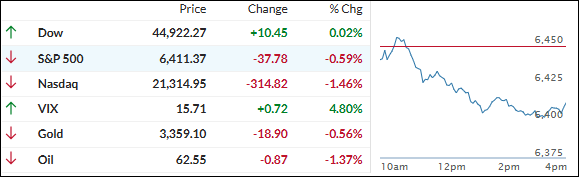

The Dow Jones surged nearly 850 points to a fresh record close, while the S&P 500 climbed 1.5% and the Nasdaq rose about 1.9%. It’s my opinion Powell’s message opened the door to a possible interest-rate cut in September, which really energized investors.

The way I see it, Powell’s acknowledgment of the fragile balance between inflation and a weakening labor market gave traders reason to hope the Fed might ease soon—but he was cautious, stressing the need to wait for incoming data first. That blend of optimism and caution set the tone for today’s gains.

Bond yields eased off a bit today, which helped soothe pressure on stocks—especially the rate-sensitive sectors. Meanwhile, technology and the Mag 7 stocks bounced back with a nice lift after a rough few days earlier this week, showing some renewed faith in growth names.

The dollar crashed, adding further fuel to risk assets, while gold stayed pretty steady, stuck in its recent sideways groove. Interestingly, Bitcoin jumped about 4%, benefiting from the overall risk-on mood among investors.

I believe this rally is a welcome break, but the way I see it, investors are still watching Powell and upcoming data closely.

The big question remains: Is this the start of a sustained rally fueled by rate cuts, or just a short-lived relief rally before volatility returns?

Read More