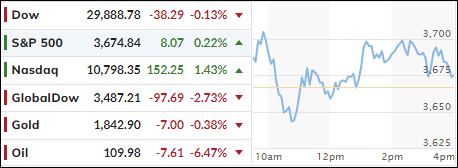

- Moving the markets

Bullish attempts to keep yesterday’s comeback alive ended up failing, as the major indexes surrendered early gains and ended up the hugging their respective unchanged lines with not much to show for.

Initially, stocks had blasted higher, despite weakness in the futures markets. For a while, it looked like we were facing another “bad news is good news” scenario, as Fed President Harker opined that the “US economy might see a modest contraction in growth,” along with “we could have a couple of negative quarters.”

This negative talk was immediately translated as being a positive for the markets, as it would move the recession into the more immediate future, which would then result into inevitable rate cuts and a new QE program. That “should” translate into a revival of the bull market, or so the theory goes.

Regarding inflation, the Fed is way behind the curve and needs to implement a far more aggressive tightening cycle. Analyst Simon Ree tweeted this amazing stat:

Once inflation goes above 5%, it has never come back down without the Fed Funds rate exceeding the CPI.

As ZH explained, the problem is that the current CPI is 8.58% and the Fed Funds rate is only 1.58%. Graphically, it looks like this. That means the Fed would need to hike at least 7% until inflation would start to roll over and potentially allow for the so-called soft landing. Good luck with that…

Despite falling bond yields, equities could not sustain any upward momentum. The 10-year plunged 12 bps to close at 3.16%. The US Dollar dumped after yesterday’s pump, while gold meandered aimlessly but closed a tad in the green.

Sure, we could see another short squeeze into the end of this quarter, but in my mind, its duration will be questionable.

Read More