- Moving the market

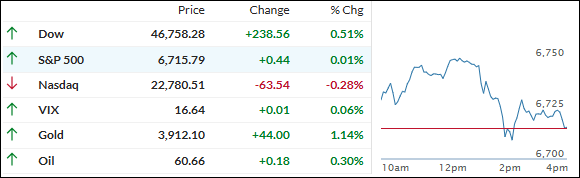

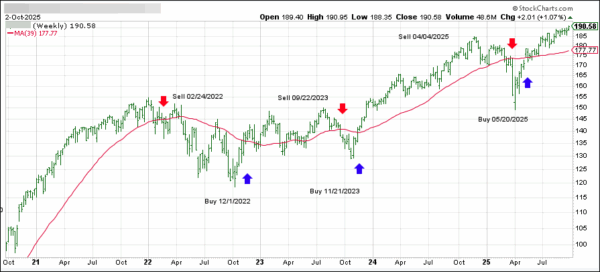

Stocks started off strong Wednesday, bouncing back after Oracle’s stumble yesterday snapped the S&P 500’s seven-day winning streak and sparked fresh questions about how long the artificial intelligence boom can last.

Nvidia shares climbed 2% after CEO Jensen Huang said computing demand has jumped sharply—especially over the past six months—helping overshadow Oracle’s warning about thin margins in its cloud business and some tough deals renting out Nvidia chips.

The government shutdown rolled into its eighth day, with the Senate readying for yet another vote to reopen things after lawmakers once again failed to pass a new funding bill earlier in the week.

Traders are also keenly eyeing today’s Federal Reserve minutes for clues about what’s next, after a heated September meeting left people guessing about Fed policy.

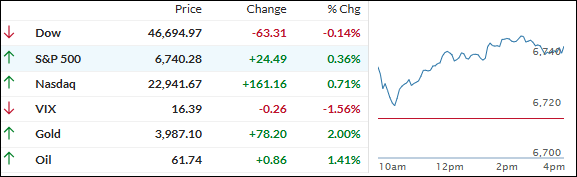

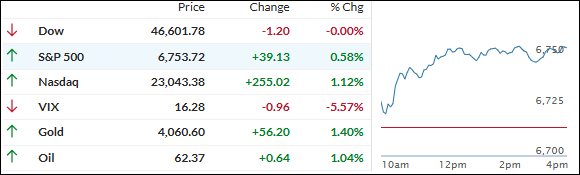

At the close, the Dow was unchanged, but the S&P 500 and Nasdaq made up lost ground and ended at new record highs—helped along by continued short-squeeze action.

Interestingly, the S&P’s “Mag 7” tech giants lagged the rest of the index today.

Gold added some drama, blasting through $4,000 to notch a record and logging a year-to-date gain of more than 55%—its best run in over 50 years and blowing away the S&P 500’s 15% climb.

Meanwhile, bond yields were mixed, bitcoin rebounded toward $124,000, and silver rallied 2.7% to edge closer to the $50 milestone.

With gold and bitcoin already breaking records, could silver be next to steal the spotlight?

Read More