- Moving the markets

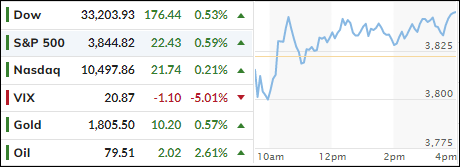

Despite a green opening, the bulls lost control in a hurry, as the bears took over and dominated the rest of the session as if to add insult to injury to a year that is shaping up to be the worst since 2008. The S&P is now on track to close 2022 with a loss of over 20%.

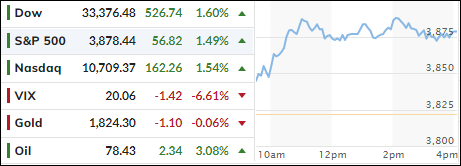

Powerhouse Apple fell another 3% and dropped through a key support level to a 52-week low. Energy was big laggard with Crude Oil now below $80, and Southwest Airlines continued its slide by another 5% amid an additional surge of flight cancellations.

Traders are now simply wishing that due to bullish momentum appearing to have been exhausted, with the much hoped for technical rally fast disappearing in the rear-view mirror, that Friday afternoon arrives without much more carnage.

Ok, but what are we looking at once the first trading day of 2023 arrives next week? China, Covid, energy issues, a weakening economy (lower earnings?), Ukraine, and hawkish Central Banks do not paint a picture of calmness or balance conducive for the bulls.

With my Trend Tracking Indicators (TTIs-section 3) having hugged their trend lines in the recent past, but now are showing a southerly tendency, I would not be surprised to see a “Sell” signal in the near future, which could be as soon as next week.

Read More