- Moving the markets

Even though the Fed did exactly what was expected, namely hiking rates by only 0.25% to the 4.75%-5% target range and confirmed that Quantitative Tightening (QY) will continue as had been assumed, the markets reacted violently.

Trying to spew some words of reassurance, Powell added:

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.

Yet, he also added a hint of hawkishness by changing his reference about inflation from “has eased somewhat” to “remains elevated.” And “rate cuts are not in our base case.”

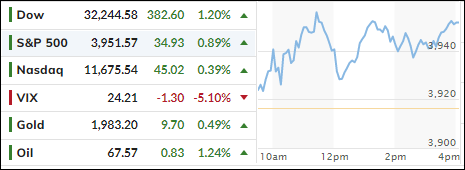

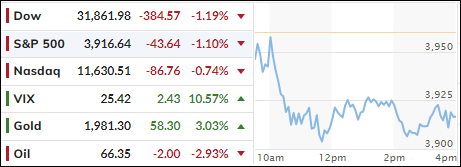

With traders dissecting his every word, uncertainty reigned after the release with the markets at first aimlessly bobbing and weaving, as the S&P chart above shows. However, in the end, chaos set in with traders and algos pushing the “sell” buttons and sending the major indexes plummeting into the close.

Regional banks took a hit, as ZeroHedge pointed out, with First Republic Bank getting hammered, while REITS lost their recent upward momentum again.

Bond yields dropped, after an early rise, with the 2-year thriving and then diving back below its 4% level. The US Dollar dumped to 6-week lows, which gave Gold the opportunity to shine, and the precious metal delivered by rallying +1.82%.

Will the bulls grab the baton tomorrow and view this sell off as a buying opportunity, or will the bears rule? We’ll find out over the next few days.

Read More