- Moving the markets

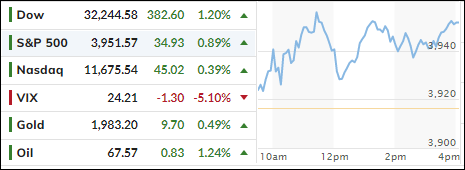

Market bulls received news on the banking crisis that they interpreted as hope that things are not as bad as feared due to the takeover of Credit Suisse by UBS, which appeared to be nothing more than a forced wedding by the Swiss government.

The broad markets advanced, and even regional banks rebounded a tad from their big losses last week with the KRE index recovering 1.2% after having tumbled 14% during the prior 5 trading days.

In my view, the crisis has barely started, but at least for the moment, issues are said to be contained with all eyes now focused on what the Fed will do regarding interest rates when they meet this coming Wednesday.

Still, First Republican shares crashed 48% to a new record low, as ZeroHedge reported, despite last week’s $30 billion inflow bailout. Ouch! Could this be a harbinger of things to come?

For sure, if you were a Credit Suisse AT1 bondholder, you lost 100% of your investment during the merger, as equity holders received preference courtesy of Swiss taxpayers, while these bonds were wiped out.

US Bond yields closed higher, with the 2-year staging a wild ride, as the US Dollar slipped. Gold ramped past its $2k level but pulled back into the close for a modest gain.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs reversed, which tells me that we are still in the neutral zone confirming that major market direction is still sideways. Until that changes, we will remain in “Buy” mode—but with only very limited exposure.

This is how we closed 03/20/2023:

Domestic TTI: -1.88% below its M/A (prior close -2.65%)—Buy signal effective 12/1/2022.

International TTI: +2.62% above its M/A (prior close +1.84%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli