- Moving the markets

I was pondering yesterday if, in the absence of a bullish driver, the markets might take the path of least resistance, which would be down. That was the case today, as the major indexes opened in the red, with the bears taking over and manhandling any bullish sentiment with utter ease, thereby assuring a red close.

First Republic Bank’s (FRC) latest earnings set the negative mood and spiked concerns about a broadening of the banking crisis, something that I have posted about since the SVB breakdown.

Shares of FRC got clobbered at the rate of over 49%, after deposits dropped 40% but allegedly have now stabilized. Promises of trimming expenses and slashing headcount did nothing to stem the tide, because investors remained concerned that FRC would experience a similar destiny as Silicon Valley Bank.

Other earnings reports were mixed, but all eyes are now on the report cards of the big boys like Microsoft and Alphabet, which are due out after the close today. Maybe they can restore some bullish sentiment.

Economic news did nothing to relieve traders of uncertainty, as the Fed’s Services Index dumped to its weakest since Covid, while the Confidence index slumped, and the US Home Growth popped a tad but remained at its slowest in a decade. The combined effect was a further drag on the Citi Surprise Index.

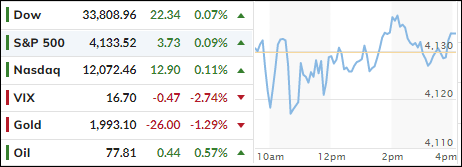

Bond yields plunged with the 2-year again dropping below its 4% level. The US Dollar rebounded despite lower bond yields, and gold made two attempts to reclaim its $2k level but failed. Still, the precious metal gained 0.36% on the session.

I think the markets are too complacent about the upcoming debt ceiling debacle. After all, we are stuck in the middle of an ongoing banking crisis and a deteriorating economy.

Hmm…

Read More