- Moving the markets

The stock market celebrated another day of low inflation, as the Producer Price Index (PPI) for June came in much weaker than expected. The PPI measures the change in prices that producers charge for their goods and services. It was supposed to rise by 0.4% year-over-year, but it barely budged at 0.1%.

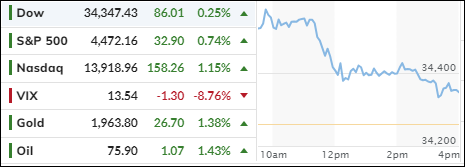

This was music to the ears of Wall Street, which loves cheap money and hates high interest rates. The major indexes rallied for the fourth day in a row, except for the Dow, which fizzled out after a strong start and ended with a tiny gain.

The short sellers, who bet against the market, got squeezed again and had to cover their losses by buying back the stocks they sold. The PPI report followed yesterday’s Consumer Price Index (CPI), which also showed a slower pace of inflation than anticipated.

However, the labor market remains tight, as the weekly jobless claims did not fall as much as hoped. In fact, without some seasonal adjustments, they would have risen to the highest level since January.

The market’s reaction to these reports was to lower its expectations for future rate hikes by the Federal Reserve. Traders now think that the Fed will raise rates by 0.25% later this month, but then pause until next year and even cut rates in January 2024. That sounds too good to be true, and I’m not sure if the market is being realistic or delusional.

The dollar took a beating and dropped for the sixth consecutive day, which was its worst streak since July 2020. And that’s the problem. A weaker dollar makes imports more expensive and fuels inflation, which could force the Fed to raise rates faster and more aggressively than the market expects.

Bond yields fell, with the 2-year yield hitting 4.6%, while gold drifted sideways but kept its gains from yesterday.

Tomorrow, we will see the start of the earnings season, with the big banks reporting first. Expect some swings in the market, but also some positive surprises.

Why?

Because the earnings expectations are so low that even a turtle could clear them.

Read More