Even the WSJ recently touched on one of my pet peeves I wrote about recently as I was reviewing the book “Why Business People Speak Like Idiots.”

Even the WSJ recently touched on one of my pet peeves I wrote about recently as I was reviewing the book “Why Business People Speak Like Idiots.”

Their article was named “Most Annoying Business Expressions” and covered some of the blown up phrases that could be translated into a simple word for everyone to understand. Here are some of the highlights:

Paradigm shift. The most overblown euphemism for “change.”

Swung to a profit/loss. A staple of Wall Street Journal earnings stories, it conjures images of Tarzan as an accountant.

Downsize (or its variations including “right sized” or “reductions in force”). They’re being fired, folks.

Sell off. There is no selling without buying

Leaving for personal reasons/to spend more time with his family. Yeah, right.

The pendulum has swung too far. I’m not a physicist, but pendulums by definition can’t swing too far.

We are cooperating fully with the investigation. After which our CEO will be leaving to spend more time with his family.

Profit taking. It’s called selling.

Merger of equals. The business version of jumbo shrimp.

Forward-looking statements. Lawyers must get paid by the word. For the rest of us “forecast” or “prediction” works just fine.

Reviewing our strategic alternatives. It’s called selling.

Quiet period. A legal fiction that grew out of a rule prohibiting companies from hyping their stock before selling shares to the public.

Pre-owned. A mangling of the English language to avoid the truth: used.

Pre-approved. A mangling of the English language to hide how lenders see you: a sucker.

Zero-percent financing/interest. How about “no interest?”

The customer experience. I don’t want to have an experience. I just want to buy stuff and leave.

Maximize shareholder value. Companies that talk about it usually aren’t doing it.

There you have it. If you have some to add, feel free to send them to me. Don’t keep those gems to yourself.

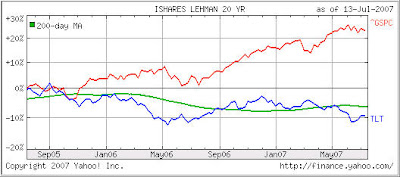

It’s no secret that new ETFs are being brought to the market as fast as sponsors can obtain regulatory approvals. I have touched on this before that having all these investment choices available does not mean you should jump on the band wagon and buy any new offering.

It’s no secret that new ETFs are being brought to the market as fast as sponsors can obtain regulatory approvals. I have touched on this before that having all these investment choices available does not mean you should jump on the band wagon and buy any new offering.