Whenever markets pull back, as they did yesterday, I look at my data base to see which no load funds/ETFs go against the grain by staying even or actually going up.

Whenever markets pull back, as they did yesterday, I look at my data base to see which no load funds/ETFs go against the grain by staying even or actually going up.

In the name of diversification, I always like to own positions that are following an uptrend strongly, yet have the ability to resist sell offs. Sure, it’s what every investor is looking for. It worked for us yesterday, as most of the super stars of the recent past gave back some gains, but our position in XBI (Healthcare) actually gained a strong 1.73%.

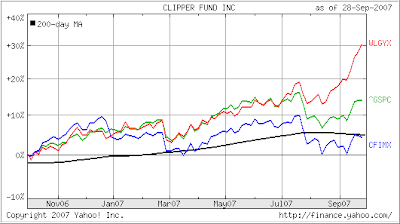

I have noticed a reoccurrence of this over past few months, as the S&P; 500 pulled back, XBI advanced. Take a look at the chart:

Just about after the August sell off, a “disconnect” between the S&P; 500 and XBI occurred, which was just about the time we entered this position. While no one knows if this will continue, it has worked well for my clients’ holdings over the past couple of months.

This is not a recommendation for you to follow suit and jump in, but merely a suggestion for you to do your own research to see if this ETF makes sense to you.