With almost daily news about banks having taken, or are about to, tens of billions of dollars in write-downs due to the real estate/credit bubble, you may be wondering how this whole mess got started.

With almost daily news about banks having taken, or are about to, tens of billions of dollars in write-downs due to the real estate/credit bubble, you may be wondering how this whole mess got started.

Sure, you’ve been catching news pieces here and there, but what caused this dilemma in the first place? How can Subprime mortgage investments have spread like a virus with such force and intensity that institutions around the world have become infected?

While I have been posting on that subject for about a year, 24/7 Wall Street featured an article titled “Quants gone wild – The Subprime crisis.” It’s a bit lengthy but a worthwhile read if you need a refresher in what has happened and who messed up.

Here is the conclusion:

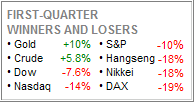

So where are we today? Well, regulatory accounting requirements mandate that publicly owned investment banks write down assets of questionable valuable. CMOs/CDOs/SIVs do come to mind. Massive write-downs have wiped out huge chunks of capital and crippled investment banks’ ability to act as financing institutions—and there is more carnage to come. This is important as there is real risk that if the flow of credit from the impacted financial houses tightens further—those that supply vital credit to both consumers and companies—the downturn we’re moving into will be deep and long.

The economic effect of missed mortgage payments, estimated at five to ten percent of all mortgages outstanding, is not by itself catastrophic, but the global financial system is at risk. This time though, the entire global financial system is so choked with all this structured debt paper, related derivatives and capital account hits that it is struggling to breathe. We should also note that as consumers slow their spending, major companies in the Dow (the great bulk of which are in the real economy—you know, the one that provides actual products and services) continue to report solid earnings. So amid the turmoil, the fundamentals of the U.S. economy remain healthy.

A couple closing thoughts: don’t run with the lemmings; don’t be overly impressed with things you don’t understand; drink some green tea and take time to write a Haiku as we witness a staggering capital meltdown from the consequences of uncontrolled financial engineering in derivatives currently estimated at US$500 trillion globally.

The big unknown time bomb remains the derivative problem, since there is no way to ascertain who is involved to what extend. Just the mere fact that this is a $500 trillion global entanglement has turned this investment arena into a casino with no limit.