The WSJ had a feature on Barclays Global Investors new launch of an all-world stock fund, the exchange traded iShares ACWI Index Fund (ACWI). Here are some highlights:

The WSJ had a feature on Barclays Global Investors new launch of an all-world stock fund, the exchange traded iShares ACWI Index Fund (ACWI). Here are some highlights:

Early this month, Vanguard Group announced plans to launch Vanguard Global Stock Index Fund. Vanguard’s first global index-tracking fund will offer both exchange-traded shares and traditional mutual-fund shares.

Northern Trust is also getting in on the global game, with plans for the NETS Dow Jones Wilshire Global Total Market Index exchange-traded fund. An ETF resembles a traditional mutual fund but trades on an exchange like a stock.

These one-stop-shopping global funds offer great diversification and convenience and can make a sensible core holding for investors, fund analysts say. Both the MSCI All Country World Index, tracked by the iShares ETF, and the FTSE All-World Index, the benchmark for Vanguard’s planned offering, include roughly 2,900 stocks from nearly 50 countries.

While broad U.S.-stock funds have traditionally formed the core of many investors’ portfolios, “the investment world is going to move toward using these global index funds as core funds,” says Daniel Wiener, an investment adviser and editor of a newsletter about Vanguard funds.

…

For investors planning to use such funds as a core holding, of course, expenses are key. ETF shares of the Vanguard fund will charge annual expenses of 0.25% of assets, while the iShares ETF charges 0.35%. The Vanguard fund’s mutual-fund shares, meanwhile, will charge 0.45% plus a 0.15% upfront “purchase fee.” Vanguard spokeswoman Amy Chain says the fees are expected to come down as the fund attracts assets.

Investors may be able to construct a cheaper global index portfolio using building blocks like Vanguard Total Stock Market Index Fund (VTSMX), which holds U.S. stocks and charges expenses of 0.15%, and Vanguard Developed Markets Index Fund (VDMIX), which charges 0.22%.

But Mr. Wiener argues that an actively managed fund may be a better bet for all-world investors — even those looking for low-cost options. He points to Vanguard Global Equity Fund (VHGEX), which charges expenses of 0.64% and has substantially outperformed global stock benchmarks over the long haul.

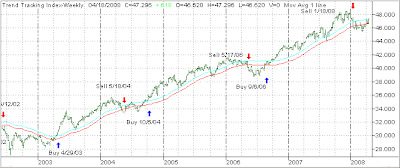

While such an ETF may provide some value in the future, don’t be swayed to jump right in. I for one will want to see price activity for some 9 months in order to be able to identify a trend.

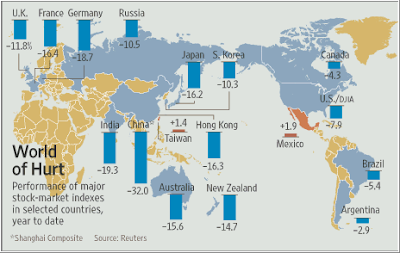

Don’t fall for “using these global index funds as core funds,” because that means buying and holding no matter what. With the uncertainties in the market place, there is not one fund/ETF around that would qualify to be held without regards to market direction.

To survive these tumultuous times with your portfolio intact, you have to be sure that you are always on the right side of the market. That means you need to adopt the time tested saying “let the trend be your friend” when making any kind of investment decision.