Most likely, you’ve been reading the Fannie Mae and Freddie Mac debacle, and the various plans for a bail out, along with banning naked short selling. Bill Fleckenstein had an interesting piece on the subject called “Feds can’t fix Fannie and Freddie.” Here are some highlights:

Most likely, you’ve been reading the Fannie Mae and Freddie Mac debacle, and the various plans for a bail out, along with banning naked short selling. Bill Fleckenstein had an interesting piece on the subject called “Feds can’t fix Fannie and Freddie.” Here are some highlights:

Fannie Mae (FNM, news, msgs) and Freddie Mac (FRE, news, msgs) do not have a liquidity problem that can be solved by the Federal Reserve or even by an injection of Treasury capital. It’s a solvency issue. Short-term cash isn’t the real problem. Over time, the mortgage giants’ liabilities are quite likely to swamp their assets. Thus their assets are contingent, but their debts are forever.

Further, if the Treasury is the only entity left willing to buy shares to shore up Fannie and Freddie, what will happen to other troubled financial institutions? Between now and the year’s end, more mortgages will percolate through those institutions’ balance sheets, creating losses that will force them to seek capital as well.

…

Turning to wrongheaded finger-pointing, I found it interesting that Securities and Exchange Commission Chairman Chris Cox wants to amend rules for naked short selling (though his proposals are much ado about nothing, as it is already illegal), specifically in the cases of Fannie, Freddie and certain brokers. I know I’ve said this before, but since there’s been so much chatter about short sellers, let me once again try to make this perfectly clear:

Short sellers didn’t create the housing bubble, which is what caused the unfolding disaster. Nor did they make the bad loans now going sour. Short sellers do not ruin companies, and they are incapable of driving a company’s stock price lower for more than a brief moment. If unscrupulous manipulators decided to pressure a stock lower, that would be a recipe for losing money unless they were extremely quick, not only to sell but also to cover the short position.

Likewise, short sellers didn’t cause Bear Stearns to collapse. That was a do-it-yourself job, executed by the arrogant chieftains who let themselves get wildly over-leveraged.

And someone might tell Cox that short sellers didn’t ruin Fannie Mae. That was the handiwork of former CEO Franklin Raines and the rest of management (as well as the regulators), whose Enron-like greed caused me to name the company “Fanron” on Feb. 23, 2005. As I wrote in my daily column on my Web site that day:

“Problems there definitely matter, since Fannie has been one of the primary engines that finance the housing ATM. In yet another turn for the worse, OFHEO stated that it has ‘identified (additional) policies that it believes appear inconsistent with generally accepted accounting principles.’ When I read this morning’s OFHEO headlines (concerning Fannie’s ‘held for sale’ loans and ‘use of FAS 140’ hedge accounting), I thought this smells, just like Enron, ergo, my new nickname for Fannie — Fanron.”

This business of blaming short sellers for lower stock prices (and speculators generically for high oil prices) is getting ridiculous, especially when the real perpetrators suffer minor consequences as they walk away with giant piles of money.

Bill hits the nail on the head with his analysis. Only time will tell if any of these attempts of rescuing insolvent institutions will fail or succeed. My guess is that they will fail, and the tax payer will ultimately be the only one left to pick up the tab in one form or another. Déjà vu!

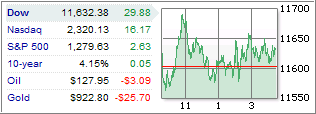

Despite last week’s bounce in the market, we really have gone nowhere. The S&P; 500 started the month at 1,280 and closed at that number yesterday. Despite some sharp drops during the first couple of weeks in July, it’s questionable whether the subsequent rebound rally has legs, as economic circumstances have not changed.

Despite last week’s bounce in the market, we really have gone nowhere. The S&P; 500 started the month at 1,280 and closed at that number yesterday. Despite some sharp drops during the first couple of weeks in July, it’s questionable whether the subsequent rebound rally has legs, as economic circumstances have not changed.