It’s no secret that the credit/banking crisis has the potential of bringing down not just only small banks but some of the big boys as well. As I mentioned before, the FDIC has hired some retired bank specialists who were involved in the S&L; crisis back in the 80s. That appears to be some sort of confirmation that there is more fallout on the horizon.

It’s no secret that the credit/banking crisis has the potential of bringing down not just only small banks but some of the big boys as well. As I mentioned before, the FDIC has hired some retired bank specialists who were involved in the S&L; crisis back in the 80s. That appears to be some sort of confirmation that there is more fallout on the horizon.

The entire banking system is anything but stable at the moment as Mish over at Global Economic Trends analyzes in:

You Know The Banking System Is Unsound When…

1. Paulson appears on Face The Nation and says “Our banking system is a safe and a sound one.” If the banking system was safe and sound, everyone would know it (or at least think it). There would be no need to say it.

2. Paulson says the list of troubled banks “is a very manageable situation”. The reality is there are 90 banks on the list of problem banks. Indymac was not one of them until a month before it collapsed. How many other banks will magically appear on the list a month before they collapse?

3. In a Northern Rock moment, depositors at Indymac pull out their cash. Police had to be called in to ensure order.

4. Washington Mutual (WM), another troubled bank, refused to honor Indymac cashier’s checks. The irony is it makes no sense for customers to pull insured deposits out of Indymac after it went into receivership. The second irony is the last place one would want to put those funds would be Washington Mutual. Eventually Washington Mutual decided it would take those checks but with an 8 week hold. Will Washington Mutual even be around 8 weeks from now?

5. Paulson asked for “Congressional authority to buy unlimited stakes in and lend to Fannie Mae (FNM) and Freddie Mac (FRE)” just days after he said “Financial Institutions Must Be Allowed To Fail”. Obviously Paulson is reporting from the 5th dimension. In some alternate universe, his statements just might make sense.

6. Former Fed Governor William Poole says “Fannie Mae, Freddie Losses Makes Them Insolvent”.

7. Paulson says Fannie Mae and Freddie Mac are “essential” because they represent the only “functioning” part of the home loan market. The firms own or guarantee about half of the $12 trillion in U.S. mortgages. Is it possible to have a sound banking system when the only “functioning” part of the mortgage market is insolvent?

8. Bernanke testified before Congress on monetary policy but did not comment on either money supply or interest rates. The word “money” did not appear at all in his testimony. The only time “interest rate” appeared in his testimony was in relation to consumer credit card rates. How can you have any reasonable economic policy when the Fed chairman is scared half to death to discuss interest rates and money supply?

9. The SEC issued a protective order to protect those most responsible for naked short selling. As long as the investment banks and brokers were making money engaging in naked shorting of stocks, there was no problem. However, when the bears began using the tactic against the big financials, it became time to selectively enforce the existing regulation.

10. The Fed takes emergency actions twice during options expirations week in regards to the discount window and rate cuts.

11. The SEC takes emergency action during options expirations week regarding short sales.

12. The Fed has implemented an alphabet soup of pawn shop lending facilities whereby the Fed accepts garbage as collateral in exchange for treasuries. Those new Fed lending facilities are called the Term Auction Facility (TAF), the Term Security Lending Facility (TSLF), and the Primary Dealer Credit Facility (PDCF).

13. Citigroup (C), Lehman (LEH), Morgan Stanley(MS), Goldman Sachs (GS) and Merrill Lynch (MER) all have a huge percentage of level 3 assets. Level 3 assets are commonly known as “marked to fantasy” assets. In other words, the value of those assets is significantly if not ridiculously overvalued in comparison to what those assets would fetch on the open market. It is debatable if any of the above firms survive in their present form. Some may not survive in any form.

14. Bernanke openly solicits private equity firms to invest in banks. Is this even close to a remotely normal action for Fed chairman to take?

15. Bear Stearns was taken over by JPMorgan (JPM) days after insuring investors it had plenty of capital. Fears are high that Lehman will suffer the same fate. Worse yet, the Fed had to guarantee the shotgun marriage between Bear Stearns and JP Morgan by providing as much as $30 billion in capital. JPMorgan is responsible for only the first 1/2 billion. Taxpayers are on the hook for all the rest. Was this a legal action for the Fed to take? Does the Fed care?

16. Citigroup needed a cash injection from Abu Dhabi and a second one elsewhere. Then after announcing it would not need more capital is raising still more. The latest news is Citigroup will sell $500 billion in assets. To who? At what price?

17. Merrill Lynch raised $6.6 billion in capital from Kuwait Mizuho, announced it did not need to raise more capital, then raised more capital a few week later.

18. Morgan Stanley sold a 9.9% equity stake to China International Corp. CEO John Mack compensated by not taking his bonus. How generous. Morgan Stanley fell from $72 to $37. Did CEO John Mack deserve a paycheck at all?

19. Bank of America (BAC) agreed to take over Countywide Financial (CFC) and twice announced Countrywide will add profits to B of A. Inquiring minds were asking “How the hell can Countrywide add to Bank of America earnings?” Here’s how. Bank of America just announced it will not guarantee $38.1 billion in Countrywide debt. Questions over “Fraudulent Conveyance” are now surfacing.

20. Washington Mutual agreed to a death spiral cash infusion of $7 billion accepting an offer at $8.75 when the stock was over $13 at the time. Washington Mutual has since fallen in waterfall fashion from $40 and is now trading near $5.00 after a huge rally.

21. Shares of Ambac (ABK) fell from $90 to $2.50. Shares of MBIA (MBI) fell from $70 to $5. Sadly, the top three rating agencies kept their rating on the pair at AAA nearly all the way down. No one can believe anything the government sponsored rating agencies say.

22. In a panic set of moves, the Fed slashed interest rates from 5.25% to 2%. This was the fastest, steepest drop on record. Ironically, the Fed chairman spoke of inflation concerns the entire drop down. Bernanke clearly cannot tell the truth. He does not have to. Actions speak louder than words.

23. FDIC Chairman Sheila Bair said the FDIC is looking for ways to shore up its depleted deposit fund, including charging higher premiums on riskier brokered deposits.

24. There is roughly $6.84 Trillion in bank deposits. $2.60 Trillion of that is uninsured. There is only $53 billion in FDIC insurance to cover $6.84 Trillion in bank deposits. Indymac will eat up roughly $8 billion of that.

25. Of the $6.84 Trillion in bank deposits, the total cash on hand at banks is a mere $273.7 Billion. Where is the rest of the loot? The answer is in off balance sheet SIVs, imploding commercial real estate deals, Alt-A liar loans, Fannie Mae and Freddie Mac bonds, toggle bonds where debt is amazingly paid back with more debt, and all sorts of other silly (and arguably fraudulent) financial wizardry schemes that have bank and brokerage firms leveraged at 30-1 or more. Those loans cannot be paid back.

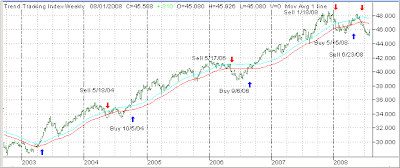

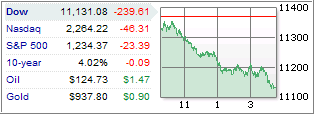

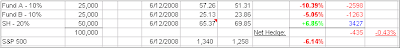

It’s not my intention to dwell on negatives but to simply be realistic as to where we stand economically. It’s important that you are aware of the items Mish discussed, which essentially support my view that we are in a bear market and will be for some time. Don’t fall prey to any feel good rallies until the trend has reversed and clearly demonstrates that better times are ahead.