The fallout from the credit crunch has been well documented, because the top names in investment banking had to cumulatively write down so far in excess of some $500 billion dollars with no end in sight. In case you missed it, Merrill Lynch has held the dubious #1 ranking when comparing losses to historical profits.

The fallout from the credit crunch has been well documented, because the top names in investment banking had to cumulatively write down so far in excess of some $500 billion dollars with no end in sight. In case you missed it, Merrill Lynch has held the dubious #1 ranking when comparing losses to historical profits.

News reports had this to say (sorry, no link available):

Merrill Lynch’s losses in the past 18 months amount to about a quarter of the profits it has made in its 36 years as a listed company, according to Financial Times research that highlights the extent of the global banking crisis.

Since the onset of the credit crunch last year, Merrill has suffered after-tax losses of more than $14 billion, as its balance sheet has been savaged by almost $52 billion in write-downs and credit-related losses.

Merrill’s total inflation-adjusted profits between its 1971 listing and 2006 were about $56 billion, according to figures from Thomson Reuters Fundamentals and an FT analysis of reported earnings.

The $14 billion in losses for 2007 and the first two quarters of 2008 equal half of Merrill’s profits since the beginning of the decade.

Merrill had the highest ratio of credit-crunch losses to historical profits among 10 U.S. and European financial groups analyzed by the FT. The other banks studied: Citigroup, JPMorgan Chase, Bank of America, Morgan Stanley, Goldman Sachs, Lehman Brothers, Credit Suisse and UBS.

UBS, which has lost more than $15 billion during the crisis, had the second-highest ratio.

[Emphasis added]

This describes investment banking in a nutshell, as I have posted about previously. Companies use sophisticated computer models that can make tremendous amounts of profits but rely on computations and assumptions which do not include the rare Black Swan event.

Every so often a blow up occurs, which has the potential to completely wipe out companies, such as happened with LTCM (Long Term Capital Management) in 1998, when a stable of the brainiest investment people along with Nobel laureates placed ill-timed trades without a plan to exit in case their assumptions proved incorrect. I reviewed the book in “When Genius Failed.”

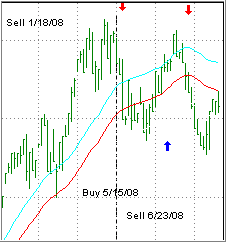

Nassim Taleb writes in “Fooled by Randomness” that this is a frequent occurrence and no one seems to have learned from the past. He states that simple techniques such as using sell stops are rarely used by “professionals.” Hard to believe, isn’t it?

Recent news reports state that Merrill is still having problems unloading some troubled holdings. Undoubtedly, this will continue until every company owning garbage assets has finally cleaned up their balance sheets.

Common sense would dictate that coming clean all at once, spilling your guts and getting it over with would be the fastest way to a new beginning rather than hanging on to continuously deteriorating toxic holdings. Maybe some of the companies would prefer that approach, but can’t.

Why?

Could it be that if they produced a “marked to market” type balance sheet that it might disclose that they are no longer a viable entity?