The WSJ featured a niece piece titled “One Week Later, a New World Order,” which reflected on the amazing events of this past week. In case you missed some of the action, here are some excerpts:

The WSJ featured a niece piece titled “One Week Later, a New World Order,” which reflected on the amazing events of this past week. In case you missed some of the action, here are some excerpts:

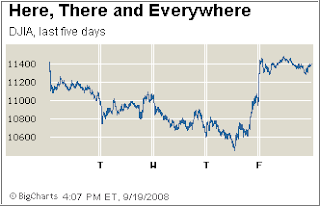

Years from now, number-crunchers looking at weekly changes in the Dow Jones Industrial Average will look at the week ending Sept. 19, 2008, and see that the Dow managed a paltry 33-point decline for this most recent five-day period.

It’s a 33-point move by way of a 1000-point swing. The exhausting roller-coaster of the last five days would have traders happy to see the weekend arrive were it not for the anticipation of more activity from federal regulators and Wall Street bankers over the weekend. It will be difficult to surpass the sinking feeling investors had this past Monday, however, when several large financial companies were teetering on the brink all at once.

Just five days and a bankruptcy, a government takeover and a shotgun merger later, the American financial system has been completely reordered, and more changes in the regulatory framework and on Wall Street are likely to come in the next few years.

“I’ve been trading 23 years, and I can finally say this has eclipsed what I saw the week before and the day of the 1987 market crash,” says Tom Alexander, president of Alexander Trading. “I didn’t think I’d ever say that. So many things have changed so quickly, maybe even more so than 1987.”

The two-day, 800-point rally on the Dow industrials has most assuredly left traders with a sense of renewal after the crushing losses earlier in the week, but the cost is likely to be great. A temporary ban on short-selling of 799 financial issues goosed that sector, which led the way, but left Mr. Alexander wary of what’s next to come, as he judges most of this rally to be short-covering.

The last few weeks have progressed with an air of foreboding. Large fund managers weeks ago were warning that American International Group Inc. needed $15 billion to $25 billion in capital, with one saying that “they’re the one that scares me the most.” In the end, they’re the one that received the most in the way of government help — but at the highest cost, interest rates north of 11% as it currently stands.

Through the 13 months of this winding credit crisis, the prevailing hope among investors, banks and traders was that the next development, be it major write-downs from an investment bank, unloading of terrible assets, another interest-rate cut, or the announcement of a new lending facility, would be the definitive one that would “get us past all of this.” It was the slump in subprime, the Bear Stearns fiasco, and then the TSLF, and then the Fannie/Freddie bailout.

This past week that scenario played out at the speed of light, with traders digesting the news of the Lehman Brothers bankruptcy and responding not with relief, but by moving on to the AIG feeding frenzy.

The financial death spiral produced memorable hair-trigger decisions that may, in hindsight (following the Treasury’s “enough is enough” moment Thursday afternoon), look hasty, such as John Thain’s decision to partner the vaunted Merrill Lynch firm with Bank of America.

That short-selling ban may have been enough to save Merrill, but as the saying goes, you can’t unring that bell. Then again, what’s happened at the end of this week may only be a postponement of the execution, with Hank Paulson’s hand on the lever, deciding the fate of money-market fundholders, short-sellers, and the nation’s largest financial institutions.

“It creates stability, but long-term, the fundamentals remain the same,” says Keith Springer, president of Capital Financial Advisory Services in Sacramento, Calif.

Some of that uncertainty will be resolved this weekend with the potential formation of some kind of “bad bank” structure that would buy up the underperforming, hard-to-sell assets sucking all the air out of Wall Street’s firms. It may prove ephemeral, because it will force those firms to sell these assets at bargain-basement prices to the U.S. Garbage Barge Trust, or whatever it will be named, and already there is talk that some are unhappy with that.

…

In the annals of history last week will be remembered as the implosion. But the market heads into next week treading on a landscape where short-selling is prohibited, the government is engineering some kind of Golem-like structure to cleanse balance sheets, and investors cannot be sure if the two-day rally was for real or a mirage.

Consider it sort of a financial demilitarized zone, where little remains, save perhaps for overturned tractor-trailers with piles of nickels lying about.

Short-term stability has been achieved but at tremendous cost. Over the next few weeks and months we will see whether applying a quick-fix solution has any merit and affects staying power as far as the financial markets is concerned.

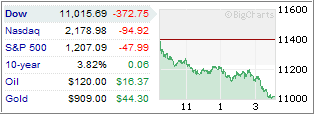

The markets tanked again yesterday as much uncertainty about the proposed government bailout package prevented traders from chanting that happy days are here again. The bears ruled, and I expect this volatility to continue for quite some time.

The markets tanked again yesterday as much uncertainty about the proposed government bailout package prevented traders from chanting that happy days are here again. The bears ruled, and I expect this volatility to continue for quite some time.