As you can imagine, with the markets having taken an unprecedented dive over the last few months, mutual funds have seen and outflow of assets as (hopefully) many investors realized that holding on to bullish funds in a bearish environment can be hazardous to your financial health.

As you can imagine, with the markets having taken an unprecedented dive over the last few months, mutual funds have seen and outflow of assets as (hopefully) many investors realized that holding on to bullish funds in a bearish environment can be hazardous to your financial health.

MarketWatch reports that “Mutual-fund firms rocked by asset decline:”

After seeming to weather the worst of the credit storm, the mutual-fund industry has been getting walloped, losing more than 20% of assets under management in just five months.

Data from research firm Lipper show that as of Oct. 31, mutual funds of all types — stock funds, bond funds and money market funds — had $9.5 trillion in assets. That’s a 20.8% drop from where the industry stood on May 31 when it sported a record $12 trillion under management.

Mutual funds have lost 19.3% of their assets in the first 10 months of the year after closing 2007 with $11.7 trillion under wraps. This puts the industry on pace for one of the worst years in its history.

According to Lipper, since 1959 — the first year for which it has data — the largest year-on-year asset declines came in 1973, when assets dropped 20.4% to $3.4 billion, and 1974, when assets fell by 21.4% to $2.7 billion.

Mutual funds’ total assets were last below $10 trillion in December 2006.

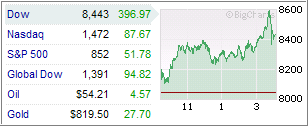

The pain may not be over for the industry. The Dow Jones Industrial Average is down more than 10% in November, and there’s no reason to believe that investors are returning to the market.

“Funds are still going to have difficult periods to go through,” before things turn around, said Tom Roseen, senior analyst at Lipper. “We might not start seeing some people returning by next summer.”

Mutual funds have been whacked by a combination of falling asset values and redemptions. Average total returns of all stock funds, U.S. and international, are down 50% this year, causing the fall in asset values.

The sharp decline has also led to investors heading for the exits: October saw record dollar net monthly outflows from stock funds of $86 billion. The first 10 days of the month saw the Dow fall 28%.

Fixed-income funds also saw record dollar net outflows of $44.3 billion. The previous worst months of net outflows were September 1992, which saw $37 billion exit, and May 2004, when there were net outflows of $16.7 billion.

“Bond funds just got crushed,” in October, said Roseen, who added that much of the outflows were from investors leaving intermediate investment-grade debt. “People just don’t trust the ratings for these things any more,” he said.

Amid the carnage, money market funds have bounced back from the mid-September panic caused when Reserve Primary Fund “broke the buck” as its net asset value slipped below $1 a share.

That event caused a run on money market funds that saw $120 billion leave in one week but, buoyed by the Treasury’s guarantee program, the sector’s assets are now higher than they were before the panic as investors head into safer short-term debt. Treasury said on Monday that it was extending the insurance program until April 30.

Net inflows into money market funds in October were $169 billion, the second-largest on record, behind the $175 billion in net inflows in Aug. 2007 when concerns about the credit crisis first hit investors. “People are going for shorter durations, especially Treasury and government debt,” Roseen said.

But despite the brighter picture for money market funds, Roseen said 2009 could be just as tough as this year for mutual funds, citing both the experience of 1973 and 1974 — two bear-market years — and the early 2000s.

“Stock mutual fund returns in 2003 were 33.8% — the best since 1967 — but you saw very little in net inflows because people were still scarred by what had happened in 2001 and 2002,” he said. In those years, average total returns were down 9.3% and 17.8%, respectively.

This year, with average total returns down 50%, will likely leave even deeper mark on investors. Said Roseen: “This is a bad burn.”

I sure hope that investors have learned their lesson, although most likely at great costs, that bear markets are to be avoided no matter what. Since this one is, at least from my vantage point, just in the beginning stages, investors will want to make sure that a turnaround is the real thing before committing any serious money.

So forget the not so gentle nudges of the financial services industry that “stocks are cheap” or there are “good values out there” and focus on the direction of the long-term trend, which to me seems to be the only real thing in an economic environment where it’s almost impossible to distinguish between fact and fiction.