With the formerly Big 3 automakers having been constantly in the news lately, the question asked most recently was what if GM goes broke? MSN Money had some insights as to the consequences:

With the formerly Big 3 automakers having been constantly in the news lately, the question asked most recently was what if GM goes broke? MSN Money had some insights as to the consequences:

Neither a bailout nor bankruptcy may save General Motors or the other Detroit automakers. So imagine the cost of losing GM, starting with millions of jobs.

The downfall of Wall Street icons like Bear Stearns and Lehman Bros. may have just been the warm-up.

Soon we may wave goodbye to a true American legend: General Motors.

Yes, it’s almost unthinkable that this century-old industrial giant could go the way of the DeLorean. But the maker of Chevys, Buicks and Caddies has been driven to the brink by lousy management, intransigent labor unions, high gas prices and an economic slump that has kept Americans off showroom floors.

GM cars are selling so poorly that revenue plummeted 45% in October. Its stock has slumped to levels not seen since the days when it introduced power steering. Cash flow has dried up to the point where 2009 could be the year that GM dies.

The government is debating a bailout for GM and its Detroit brethren of about $25 billion. But cash alone wouldn’t save GM, Ford Motor or Chrysler, a trio that can only facetiously be called the Big Three anymore.

Politicians would have to find the guts to stand up to the labor unions and the retirees taxing the companies’ resources. They’d have to find the courage to boot out the managers who led the automakers into this mess. Without those changes, a bailout would just be a bandage.

The alternative, using bankruptcy to slough off lenders and reorganize the way airlines have done, might not keep automakers alive either. Unlike an airline ticket, a car is a long-term purchase. Consumers say they wouldn’t buy a car from a company in bankruptcy because they worry that warranties and replacement parts might not be there when they needed them.

If I had to bet, I’d bet on a bailout — either right away in a vote on a loan package that could come in Congress as soon as this week or after Barack Obama takes over as president Jan. 20. But let’s hope real change comes with it.

Imagine the potential ramifications of losing just GM, the biggest of the Big Three.

Millions of jobs: General Motors employs 123,000 people, and losing those jobs would be bad enough. But GM’s demise could set off a chain reaction that might cost the country almost 3 million jobs. Here’s how.

General Motors regularly owes auto-part suppliers such as Delphi and American Axle & Manufacturing lots of money. If GM declares bankruptcy, a court could relieve GM of its obligation to pay off its debts to those suppliers, which could topple them. The death of GM could have a similar effect in the longer term.

“The ripple effect could be huge,” says Van Conway, a bankruptcy expert at Conway MacKenzie & Dunleavy in Birmingham, Mich., who has worked on restructurings and turnarounds in the auto sector.

“If General Motors goes down, their supply base will go down,” agrees Brett Smith of the Center for Automotive Research. That might disrupt production at Ford and Chrysler enough that those two car companies would fail as well.

In this disaster scenario, the upper Midwest could lose nearly 3 million jobs, the Center for Automotive Research calculates. It estimates the Big Three automakers employ about 240,000 workers. The car business supports an additional 974,000 jobs among suppliers and related companies, and 1.7 million jobs are created by all the money all those people spend.

Sure, foreign automakers with U.S. factories, including Honda Motor (HMC, news, msgs) and Toyota Motor (TM, news, msgs), would pick up some of the slack. But many of the cars they sell here, such as the hybrid Prius, are made abroad. So these companies wouldn’t do enough hiring to offset all the job losses, and they generally pay workers less.

The hit to the consumer: Yes, we’d all lose the option of buying GM favorites like the Malibu or the Silverado. You’d hear no more romantic songs about pink Cadillacs or red Corvettes.

But more seriously, the loss of domestic auto companies would cut the number of producers, which means less competition. The remaining automakers would raise prices, at least in the short term, predicts David Thomas, a senior editor at Cars.com. “You would be paying a lot more for a Toyota Corolla than you ever thought you would be paying.”

The hit to the press: Foreign automakers such as Honda, Toyota and Volkswagen spend far less on splashy newspaper ads than U.S. car companies do.

“That is one way they keep their costs low,” says Thomas, of Cars.com. So a GM failure would be another blow to an ailing industry already hit hard by subscription and revenue declines as readers and advertisers move to the Internet.

The cost to government: Lost jobs and lower wages means lost tax revenue. Federal, state and local governments would lose more than $156 billion in the three years after a failure of the Big Three in Detroit, the Center for Automotive Research estimates. That’s money that other taxpayers — or their children — would have to make up.

The demand for government services would likely rise as well, as many of the best-paid blue-collar workers in America started job hunting in a weak economy. Auto-sector pensions would have to be picked up by the government — a huge cost. And both autoworkers and the automakers’ retirees would likely need help with health care just as Obama and congressional Democrats were looking for ways to cover the uninsured.

The political cost: If one or all of the Big Three auto companies failed in the first year of Obama’s presidency, it could leave voters disillusioned, wiping out much of the good will he has built up and making it harder for him to lead on other issues. The loss of General Motors would also be a hit to our prestige as a nation. Americans share a passion and pride in their cars.

Practically, losing millions of good jobs will make it the task of turning this economy around that much tougher. Letting GM die is not something any politician would want to answer for.

To read the complete story, be sure to follow the above link.

While I have always been against any kind of bailout of a business gone sour, the consequences of a GM failure will be felt throughout the country. However, historically, out of the greatest adversity has always come some greater benefit, which may not be apparent at this time.

I’d like to hear your viewpoint on “should GM be allowed to fail?” Click on the comment link below and post your opinion.

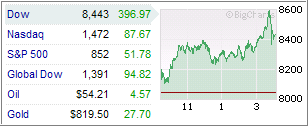

The markets continued their rebound yesterday, which started on Friday, and pushed the major indexes up over 10% in two trading days.

The markets continued their rebound yesterday, which started on Friday, and pushed the major indexes up over 10% in two trading days.