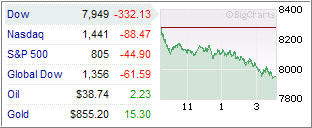

As I noted in last Friday’s market update, the major banks experienced a week of sharp stock losses causing B of A to look for more help from TARP (Troubled Asset Relief Program).

As I noted in last Friday’s market update, the major banks experienced a week of sharp stock losses causing B of A to look for more help from TARP (Troubled Asset Relief Program).

Minyanville expanded further on the subject in “Bank of America Huddling under TARP:”

The phrase “buyer beware” no longer applies in the American banking system.

Last September, as the financial markets skidded out of control, Merrill Lynch CEO John Thain sought to keep his firm from going the way of rival Lehman Brothers by selling out to Bank of America (BAC). At the time, B of A chief Ken Lewis was touted as a shrewd opportunist who seized upon a desperate rival.

Now, it appears, Lewis is the one groping for a helping hand.

According to the Wall Street Journal, the Treasury Department is preparing to offer up billions of dollars to help Bank of America complete the transaction. As in Citigroup’s (C) recent bailout, where the federal government assumed the risk for a pool of distressed assets, taxpayers are about to buy Merrill’s book of truly toxic debt.

Bank of America approached the Treasury Department in December, claiming it might have trouble closing the sale after learning Merrill’s fourth-quarter losses would be larger than expected. Fearing the deal’s collapse could inflict irreparable damage on the already wounded financial system, the Treasury is continuing to spend TARP money it doesn’t have. With the first $350 billion already allocated, Treasury Secretary Hank Paulson is dipping into funds earmarked for a second round of capital allocation that hasn’t yet been authorized.

The fact that Bank of America needs yet more money — on top of the $25 billion it received just last October — is evidence that, once again, regulators and bank executives have underestimated the scope of the debt crisis gripping the country’s financial system. Deleveraging is underway – and it’s gaining momentum. Nevertheless, lawmakers and regulators alike insist on using taxpayer money to try and slow down the accelerating juggernaut of bad debt.

To quote a recent op-ed in the Journal, which likened the government response to the current financial crisis to the circumstances described in Ayn Rand’s Atlas Shrugged:

“Politicians invariably respond to crises — that in most cases they themselves created — by spawning new government programs, laws and regulations. These, in turn, generate more havoc and poverty, which inspires the politicians to create more programs . . . and the downward spiral repeats itself until the productive sectors of the economy collapse under the collective weight of taxes and other burdens imposed in the name of fairness, equality and do-goodism.”

The similarities are so striking, it almost seems like regulators are using Atlas Shrugged as a playbook for their policy response to the crisis. They must not have waded through all 1,000 pages to see how the story ended.

The thing that gets me is that failing companies are continuously being propped up instead of being left to go under. Case in point is Merrill Lynch (ML), which is now adding nothing but toxic obligations to the balance sheet of B of A. Consequently, tax payers are on the hook for over $100 billion dollars.

If ML had been left to go under, stronger competitors would have been able to pick up the valuable pieces in form of employees and clients and integrated them into their own operations therefore becoming stronger.

Since that did not happen, the weak have been artificially kept in business with the support of TARP while those entrepreneurs, who did not lose money and survived the various bubbles, now how have to compete with incompetent firms who for all intents and purposes should no longer be around.

Therefore the question in my mind remains as to how long can you go and prop up entire industries before the realization sinks in that it was all in vain—reality will catch up sooner or later.