It’s common knowledge that a lot of hedge funds got clobbered last year along with the overall market.

Kiplinger took a look at some mutual funds that employed hedging techniques to see how they fared in last year’s environment. Here are some snippets from “Hedges That Didn’t Get Hosed:”

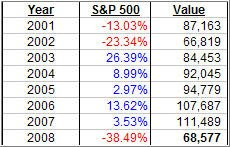

None of the funds, which promise to limit losses during severe bear markets, made money, but most did better than Standard & Poor’s 500-stock index, which surrendered 37%.

These funds all try to make money in bear markets by betting that stocks will fall. That means shorting stocks — selling borrowed shares in hopes of buying them back later at a lower price — or investing in options and futures that pay off when stocks decline.

We looked at 16 no-load funds in this category that have been around at least a year and found that all but one beat the S&P; 500 in 2008. The exception was ICON Long/Short (symbol IOLIX), which lost 40%. Six limited their losses to less than 10%, a decent showing in a year in which the average diversified domestic stock fund lost 38%.

Among the top performers were two relative newcomers: Akros Absolute Return (AARFX), launched in 2005, and Nakoma Absolute Return (NARFX), which started in 2006. They lost 3% and 4%, respectively. Others with single-digit losses for the year were James Market Neutral (JAMNX), down 5%; TFS Market Neutral (TFSMX), off 7%; Laudus Rosenberg Long/Short Equity (BRMIX), down 8%; and Hussman Strategic Growth (HSGFX), which lost 9%.

We didn’t look at so-called bear-market funds, which always bet against the markets, or inverse index funds, which rise in value as the benchmark they track falls. We also didn’t examine funds that bet against the market only occasionally. For example, Ken Heebner, manager of CGM Focus (CGMFX), a Kiplinger 25 fund, has produced stellar returns in the past, in part through shorting stocks. But he doesn’t promise to cushion bear-market losses, and he certainly didn’t in 2008; Focus sank 48%.

…

Hedge funds have long pursued strategies like these to benefit investors with million-dollar port-folios. But stock-focused hedge funds lost an average of 26% last year, according to Chicago-based Hedge Fund Research.

…

To be fair, the average market-neutral hedge fund lost only 6%. But investors pay a much higher price to buy into a hedge fund than they do to buy a mutual fund. Hedge funds typically charge 2% yearly and grab 20% of the investment gains they generate. The six top-performing hedge-like mutual funds, on the other hand, have expenses ranging from 1.1% (Hussman) to 3.3% (Laudus Rosenberg) and no performance fees.

We like the Hussman fund because of its relatively low cost and its fairly long and impressive track record (from the fund’s July 2000 inception through January 9, it returned an annualized 8.9%, beating the S&P; 500 by 13 percentage points per year). Of the six top performers, Hussman is the closest to a traditional mutual fund. Manager John Hussman invests his long-only portfolio in growth stocks. But when conditions appear dire, he tries to cut risk with options and futures.

…

Because of their hedging strategies, all of these funds are likely to lag the stock market when the bull returns. Keep in mind, though, that they are not necessarily trying to beat the market. Most are simply trying to produce steady, positive returns that don’t swing too wildly. Those that do so successfully have the added advantage of producing returns that don’t move in lock step with the broad market.

[Emphasis added]

It’s nice to hear that there actually were a few astute fund managers out in the market place who did not go down with the masses. If you are a buy and hold investor, you should not make the switch to one of these long/short funds, since their upside potential is limited due to the nature of hedging.

Regroup, by getting rid of your worst losers, and set a limit as to much more pain you are willing to endure on the downside. Then follow the direction of the major trends, whenever they become apparent, as I advocate in my weekly newsletter.

Above all, resist the temptation of bottom fishing. All of those who engaged in that extreme sport back in December have now further compounded their losses. You need to have patience to do the right thing. Overeager commitment to equities, caused by the desperate attempt to make up for past losses, will inevitably make the situation worse.