Hat tip to Random Roger for pointing to an article in the WSJ called “Advisors Ditch ‘Buy and Hold’ For New Tactics:”

Hat tip to Random Roger for pointing to an article in the WSJ called “Advisors Ditch ‘Buy and Hold’ For New Tactics:”

The broad decline across financial markets in the past year has persuaded a small but growing number of financial advisers to abandon the traditional buy-and-hold strategy — which emphasizes long-term investing in a mix of assets — for a new approach geared to sidestep future market plunges and ease volatility.

Jeff Seymour, an adviser based in Cary, N.C., used to counsel clients to buy a diverse menu of stocks, bonds and commodities, and hold on for the long run. But early last year, he says, he recognized that “the macro-economic climate has changed.”

Today, Mr. Seymour keeps about 90% of his clients’ money in such low-risk investments as short-term bonds, cash and gold. With some of the small amount that’s left over, he uses leveraged exchange-traded funds to place magnified bets both on and against the Standard & Poor’s 500-stock index.

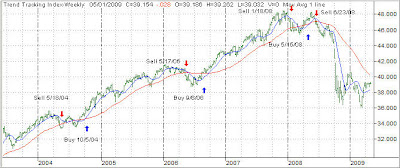

While I am glad to hear that some advisors are finally waking up to reality, I don’t see how the above strategy will yield any decent results when the major trend finally turns and favors the bulls. Being defensive during times of uncertainty is a good idea, but you need to have a plan as well when and how to assume a bullish posture again.

Buffeted by steep declines in stocks, many bonds, commodities and real estate, many advisers are questioning their faith in long-standing investment principles, such as controlling risk by building diverse portfolios. Some are adding increasingly exotic investments, including products that offer downside protection, to client portfolios. Others are trading more actively — and say they plan to continue to do so until they see evidence of a new bull market.

Trading more actively is not the answer. It sounds more like a clueless response of “having to do something” vs. implementing a strategy that deals with bullish and bearish scenarios.

To be sure, most advisers are staying the course. They point out that frequent trading leads to higher trading costs and tax bills, and that so-called alternative investments come with some serious downsides. Because the markets for many of these products are relatively undeveloped, for example, investors may face high fees, poor liquidity and a high degree of complexity.

Staying the course and doing what? Endangering clients’ assets by not having an exit strategy in place. This will do nothing but set up a repeat disaster when the markets head south again.

Critics also contend that advisers who scale back on stocks are essentially trying to time the market, and are exposing their clients to another type of risk — that of missing out on future rallies that could recoup recent losses.

Of course, if you rode the market all the way to the bottom by buying and holding into oblivion, you need to participate in all future rallies just to desperately try to get back to even. This reasoning of missing out on future rallies is one of the most abused arguments in the buy-and-hold camp. If you don’t participate in major bear market drops in the first place, you don’t need to worry about exposing your portfolio to every dead cat bounce in the market.

“By abandoning time-proven prudent techniques, they run a serious risk of destroying their own credibility and their clients’ portfolios,” says Frank Armstrong, president and founder of Investor Solutions Inc., an independent financial advisory firm in Miami that still practices buy-and-hold investing.

When losing 50-60% of a portfolio’s value, I fail to see what part of that can be considered ‘time-proven’ and/or ‘prudent.’ Credibility has already been destroyed and trust can only be regained by using investment approaches that will avoid a repeat disaster.

The changes come at a time when financial advisers are coming under pressure from clients who are tired of paying fees only to watch their savings evaporate. Advisers have “a lot of cranky clients,” says Mr. Armstrong. “They want to see something happen,” he says.

And clients have every right to be cranky when an advisor loses some 50% of their portfolios. Those clients should become ex-clients by voting with their feet.

Certain advisers have long placed small tactical bets on sectors, countries or regions they expect to outperform the broad market. Many have also placed a small portion of clients’ portfolios into alternative investments, such as commodities and real-estate investment trusts.

Shooting with a shot gun hoping that something will stick is not answer. Following trends in the market place and being exposed to those areas with upward momentum will enhance the odds of your investment being successful. Coupling that with a clearly defined exit strategy will limit your losses in case you were wrong. Why is this so difficult for many advisors to understand?

“There’s a seismic change in the market,” says Will Hepburn, president of the National Association of Active Investment Managers. “The people who were buy-and-hold-oriented lost a lot of money, and they don’t want to do it again.”

That’s been my impression to. The only way to avoid losing money again is to abandon buy-and-hold forever and become aligned with a strategy that addresses these shortcomings. I am not sure how advisors will handle the challenge of having to change to an investment strategy that will keep clients’ portfolios out of harms way when a bear market strikes.

If you read the entire article, it becomes evident that many advisors are scrambling and are looking for alternative ways to manage clients’ money. Some of the approaches featured don’t have much merit but are simply futile attempts to do something different.

To me, all these efforts will fall by the wayside as soon as is appears that the bulls continue to have the upper hand. Then it will be business as usual and caution will be thrown to the wind. When the bear returns, portfolios will be decimated again and the cycle will repeat itself just as it did during the last bear market of 2000.