MarketWatch featured an interesting article titled “ETFs may give mutual funds a run for the money.” Let’s listen in:

MarketWatch featured an interesting article titled “ETFs may give mutual funds a run for the money.” Let’s listen in:

We’ll soon find out if exchange-traded funds can live up to the hype and “replace” the traditional mutual fund.

The big headline news this week was BlackRock Inc. agreeing to buy Barclays Global Investors in a $13.5 billion deal. But the history-changing news was the registration of four new actively managed exchange-traded funds.

Most ETFs are index funds, and not portfolios based on manager intuition and research.

Grail Advisors, which develops ETFs, is looking to change that. The investment firm plans to launch four funds to be managed by RiverPark Advisors, where top management team previously was involved with the Baron Funds.

…

Bill Thomas, Grail’s chief executive officer, highlighted some clear reasons why investors could flock from traditional funds to actively managed ETFs.

“First, there’s the lower expense ratio of the ETF versus a mutual fund, so that you get the same expertise but at a lower price point,” he said.

“Then, there is transparency, the ability to know what is going on in the portfolio on a daily basis. The third advantage is that the ETF structure is more tax efficient than a mutual fund, and the fourth is liquidity, where you can trade on a moment’s notice. We now live in a world where you can trade 24 hours a day; why would you want to be in an investment vehicle that only trades once a day?”

…

For years, there has been back-room talk of how some traditional fund managers — particularly those struggling to attract assets and achieve the critical mass necessary for long-term success — might go through the conversion process and “go ETF.”

Still, active ETFs have to prove that they can back up the hype.

ETF supporters believe their vehicle is “the way to go,” but an ETF is still a mutual fund. Better platform — but the same underlying concept. Active managers can lag the market whether they run a traditional fund or an ETF.

…

So the next phase in the ETF revolution will be an explosion of active funds, but an investor who prefers managed funds shouldn’t join the revolution until they believe that an active ETF is superior to the traditional funds they hold.

I am all for alternative investment solutions, especially if they offer the individual investor freedom of choice. To me, that simply means getting them away from the world of ridiculous short-term redemption fees and minimum holding periods so common in the mutual fund industry.

If the competition between ETFs and mutual funds heats up, everyone will be better of with improved product choices and less restrictions. Eventually, mutual fund providers need to come off their high horse if they are to remain in business and compete successfully with ETFs.

Having said that, I also need to caution you that just because an ETF is actively managed, it will do no more for you than an actively managed mutual fund if you continue to follow the loser’s approach to investing by simply buying and holding.

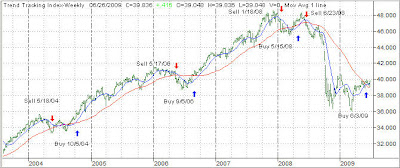

2001/02 and 2008 have proven that it does not matter what investment you are involved with, or which fancy asset allocation model you were sold, they all went down with the bear market.

Actively managed ETFs are just like mutual funds in that it is still up to you to make appropriate investments decisions (or hire someone who will do it for you) as to when to be in the market and when not.

If you think that actively managed ETFs can take that responsibility from you, you will be sadly mistaken when the bear rears its ugly head again.