The hunt for better portfolio protection during market meltdowns such as 2008 continues to go on.

The hunt for better portfolio protection during market meltdowns such as 2008 continues to go on.

MarketWatch says in “Fear Factors” that investing in the VIX (Volatility Index) could protect a portfolio in volatile markets:

Stock investors who spread money across other markets such as commodities and real estate didn’t get much shelter from 2008’s meltdown. But tapping the market’s “fear gauge” might have helped.

Investing a small portion in the CBOE Volatility Index could have provided some protection from the worst of last year’s storm, according to researchers at the University of Massachusetts.

Investable VIX products could have been used to provide some much-needed diversification during the crisis of 2008,” wrote Edward Szado, a research analyst for the Center for International Securities and Derivatives Markets at UMass.

…

The S&P; 500 lost 37% in 2008, while its value was cut in half from peak to trough as the credit crisis virtually ground the economy to a halt.

“Many assets which are typically considered effective equity diversifiers also faced precipitous losses,” Szado wrote.

Broad commodities indexes dropped by as much as two-thirds last year, and other traditional diversifiers such as commercial real estate and international stocks fell harder than the S&P; 500. Correlations jumped as asset classes fell in concert.

“In stark contrast, volatility levels as measured by VIX experienced significant increases and in 2008 repeatedly set new highs not seen since the crash of 1987,” Szado noted. U.S. Treasury bonds were also among the few winners last year amid the flight to safety.

…

Part of the UMass study focused on the last five months of 2008 when the market went into crisis mode. For this period, a U.S. stock portfolio as measured by the S&P; 500 lost 27.9%, while VIX futures rallied 269.5%, according to the paper. A portfolio comprised 90% of stocks and only 10% of VIX futures would have lost 12.1% and softened some of the blow from August to the end of December.

However, Szado warned that investors should be careful in terms of interpreting and applying the results of the analysis.

“It is important to note that the long VIX exposure is considered as a portfolio diversifier, not as a long equity hedge,” he said.

…

“The fact that the correlation between the S&P; 500 and VIX is conditional and time varying suggests that the use of hard and fast rules for hedging equity positions with VIX exposure may be ineffectual or at least challenging.,” Szado wrote.

The performance of markets in recent years “suggests that VIX may spike upwards as the S&P; 500 experiences large drops, leading one to believe that a long VIX position could provide significant diversification benefits to an equity portfolio.”

Szado is not necessarily suggesting a buy-and-hold strategy with VIX. “Since long volatility positions are expected to earn negative excess returns in the long-term, an active approach rather than a passive long volatility exposure may be appropriate,” he said.

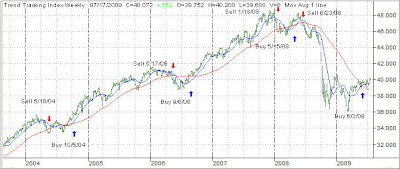

While that is all very interesting, it is far too complicated for an average investor to implement the use of the VIX index. The goal is to avoid sharp market drops, and you can do that much easier by being out of the market when the long-term trends head south.

Even the SimpleHedge Strategy, which I advocate, would have been far easier to implement with better results than attempting a sophisticated approach involving the VIX. While this may work for some, most people, who I talk to in my advisor business, like to keep things simple and understandable. And that is how it should be.

Random Roger

Random Roger