Random Roger made some interesting comments in a recent blog post regarding asset allocation appearing not to have worked during last year’s market debacle:

Random Roger made some interesting comments in a recent blog post regarding asset allocation appearing not to have worked during last year’s market debacle:

In my opinion total reliance on some sort of long standing formula is simply lazy (talking about people who get paid to manage assets). Every asset class has fundamental dynamics that change in some ways over time and over reliance on some sort of static allocation model ignores what should be intuitive; nothing stay exactly the same forever.

Most of the time asset allocation has worked and it will work most of the time in the future but not always. This ties in with the passive argument debate that pops up here occasionally. One question I always ask is whether the passive indexers do any sort of forward looking analysis. Invariably this line of thought draws out a comment or two about speculation and how difficult it is to look forward.

A big part of looking forward is to see when risks of more trouble than normal are prevalent. In a way this is the most important forward looking analysis one can do. It is certainly more important than picking between two alternative energy stocks during a bull market and betting on the one that ends up rising by 120% as opposed to the one that only goes up 80%.

I have very little sympathy for a lazy advisor who bet on the status quo and was let down. There can be no guarantee that any action taken in advance can be successful in avoiding pain but I do not know how you tell a client “I never saw this coming and it never occurred to me to try to do anything to protect your assets.”

My view is that it has not been just the lazy advisor that failed but the entire asset allocation approach to investing implemented by some 99% of all financial institutions. Asset allocation by definition is supposed to balance out declining holdings by having another portion of the portfolio go the opposite direction.

While that may have worked in the past during times of global stability, this century-to-date has shown that old rules no longer work. In the era of instant communication, along with instant everything else, the world has become a smaller more connected place. The consequence of that is that there are few areas that could be consider sheltered and oblivious to world events.

The countries that matter, from an industrialized point of view, will be instantly affected by events shaping the world. As a result, you no longer can construct a portfolio in such a way that it protects from the unknown by attempting to isolate parts of it. Nowadays, all parts are part of the big picture and move pretty much in tandem.

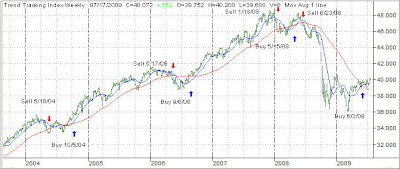

To me, asset allocation in the conventional sense no longer is a valid option as both bear markets over the past 9 years have clearly shown. If you are an asset allocation fan, that’s fine, but modify your theme to include an exit strategy, which will protect your portfolio in worse case scenarios.

As I wrote in yesterday’s post, the current rebound has the potential to make many investors complacent. Economic circumstances are such that bullish trends can easily change into bearish ones and vice versa. Be on guard and prepared to deal with either scenario.

Follow through bullishness from last week gave the markets another jolt yesterday and all major indexes gained—although on continued low volume, which makes this rally suspect.

Follow through bullishness from last week gave the markets another jolt yesterday and all major indexes gained—although on continued low volume, which makes this rally suspect.

Random Roger

Random Roger