A few days ago, a retired reader asked my opinion on a variety of income funds since his goal is to supplement his pension.

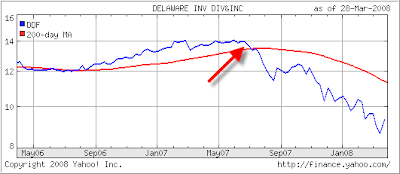

Most of the closed end funds he mentioned looked pretty much the same when looking at a chart. As an example, here is DDF:

This is the problem I have with an income generating scenario. What good is it to generate a great cash flow when, at the same time, you are losing principal at an even greater rate? It makes no sense to me.

The fund profile states the following:

The fund invests in the public equity and fixed income markets of the United States. It seeks to invest 65 percent of its corpus in stocks and 35% in fixed income securities. The fund primarily invests in value stocks of large cap companies. It also invests in convertible securities, preferred stocks, other equity-related securities, and real estate investment trusts. For the fixed income component of the funds portfolio it invests in high yield corporate bonds rated BB or lower in terms of quality.

No wonder that DDF has dropped as much as it did. All holdings have been in a sideways to down trend with currently no end in sight. From my view point, there are only 2 things you can do to avoid being stuck with heavy losses:

1. Stay on the sidelines for now, or, if you have holdings similar to the one above be sure to get out, if the price breaks below the long term trend line. Yes, that means you can’t simply afford to buy a fund for the income and forget about it. You need to track it and make adjustments every so often.

2. Use my StatSheet as a resource, especially section 10 on

Bonds & Dividend paying ETFs.The old adage that you can hang on to dividend paying stocks, bonds and other instruments forever no longer applies, because nowadays there are no guarantees that any dividend will be paid for sure, and when a reduction takes place guess what happens to the underlying asset?