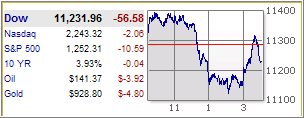

After a rebound rally on Tuesday, reality set back in on Wednesday and sent the major averages sharply down with the Dow losing some 237 points.

After a rebound rally on Tuesday, reality set back in on Wednesday and sent the major averages sharply down with the Dow losing some 237 points.

Financial stocks tanked again with Fannie Mae and Freddie Mac leading the charge by dropping an astonishing 13% and 24% respectively and reaching price levels of the early 90s. The major indexes have now all come off their October 2007 highs by more than 20% and have entered bear market territory according to the text book definition.

Our Trend Tracking Indexes (TTIs) followed suit and to no surprise, more ground was lost confirming bearish tendencies. Here’s how the TTI’s ended up as of Wednesday’s close:

Domestic TTI: -2.83%

International TTI: -12.12%

None of our positions have changed with the bulk of our portfolios being in cash, a small percentage in Swiss Francs and Gold and a limited exposure to some hedged mutual fund positions as previously discussed.