The WSJ reports that “ETFs Make Inroads With 401k Investors:”

The WSJ reports that “ETFs Make Inroads With 401k Investors:”

Exchange-traded funds have been the hot thing in the investment world these days, but not among retirement plans.

That may be changing, as ETFs finally are gaining a foothold in the 401(k) retirement-plan market.

According to estimates from BlackRock Inc., the largest sponsor of ETFs, investors hold at least $2 billion of its iShares ETFs in 401(k) plans after buying about $500 million in fund shares last year.

Since iShares controls about half the ETF market, the figure suggests that in total there may be something like $4 billion of ETF assets in 401(k)s.

That is just a tiny sliver of the more than $1 trillion in 401(k) assets invested in mutual funds, but it represents significant growth from several years ago, when ETFs were almost entirely absent from these plans.

…

Since they mostly track indexes, which don’t tend to turn over much, and often swap stocks instead of buying and selling them, ETFs don’t tend to run up capital gains taxes that are passed along to their investors.

Exchange-traded funds have struggled in the 401(k) market because retirement plans neutralize some of their key advantages.

To keep brokerage commissions low, 401(k) plans typically pool many individual investors’ trades, eliminating participants’ ability to trade all day long. Also, retirement plans already allow investors to avoid capital-gains taxes, making ETFs’ tax benefits moot.

The exchange-traded fund industry has been arguing that ETFs should still be added to plans because of their low costs.

But there is a catch here, too. The 401(k) plans already include low-cost conventional index funds—typically large plans run by big companies—and thus don’t have much reason to switch.

For that reason, BlackRock’s iShares is focusing on small plans, typically those with less than $50 million in assets, says Greg Porteous, director of its 401(k) business.

…

Unlike large plans, which often offer mutual funds run by the same company that handles back-office “record-keeping” services for the employer, many smaller plans are overseen by a financial adviser. And as BlackRock points out, financial advisers are often fans of ETFs, making the sale easier than it otherwise might be.

“There’s not a lot not to like,” says Jerry Verseput, a financial planner in El Dorado Hills, Calif. He says he’s researched 401(k) plans recently because he’d like to add retirement-planning segment to his business.

In his experience, Mr. Verseput says, plans that include ETFs have tended to offer more transparent cost schemes and lower costs over all, factoring in both the costs of the funds and the costs to administer the plans.

Unlike other 401(k) options, ETFs don’t accommodate “revenue-sharing,” or using a portion of the fees investors pay to funds to support administrative costs of retirement plans.

Many financial advisers and consumer advocates think that is good news since it makes it easier to keep tabs on what investors are actually paying for.

But it doesn’t necessarily guarantee lower costs: Some plans add separate administrative fees to make up for the money lost from the lack of revenue sharing.

Still, ETFs’ future in 401(k) plans may be limited. Vanguard Group Inc., the third-largest ETF company, and also one of the largest retirement-plan providers, says so far it hasn’t included ETFs in its retirement plans, seeing no reason to displace almost-identical index mutual funds.

[My emphasis]

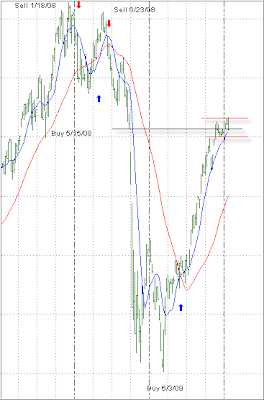

The last sentence says it all. It’s not about displacing almost identical index mutual funds. It’s all about investor flexibility to have the freedom of choice to move in and out of investments as he sees fit without not only being ridiculed but getting the shaft via ridiculous trading restrictions.

Vanguard and Fidelity are arguably the staunchest defenders of the buy-and-hold proposition no matter what market conditions are. Why? The answer is simple; because it’s good for their pockets but not necessarily for yours.