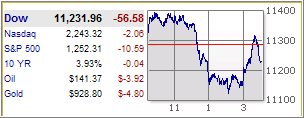

If you look at yesterday’s chart of the Dow (thanks to MarketWatch), the word cliff diving comes to mind. Good thing that there was some type of recovery, or it could have been a real ugly day.

If you look at yesterday’s chart of the Dow (thanks to MarketWatch), the word cliff diving comes to mind. Good thing that there was some type of recovery, or it could have been a real ugly day.

When all was said and done, the widely followed S&P; 500 closed at its lowest point since July 2006. It is obvious that confusion reigns, with heavy selling focused on the financials. There seems to be some panic in that sector and one analyst was quotes as saying that “the CEOs and financial officers in that industry aren’t lying when insisting that the worst is over, but they don’t understand the depths of the problem.”

I agree with that and an article from a German newspaper seems to support a similar view.

Translated, the article says that, according to a study, the crisis in the financial community is to be far worse that expected. Bridgewater Associates, the second largest hedge fund in the world and advisor to many top banks, estimates losses of $1,600 billion vs. the $400 billion which so far have been realized.

If that comes to pass, it will spell trouble for many financial institutions. However, since we don’t control that outcome, we remain in trend following mode. As of yesterday, here’s how our Trend Tracking Indexes (TTIs) stand:

Domestic TTI: -3.10%

International TTI: -11.68%

These numbers confirm that we are in a bear market, which means that we have most of our assets safely in money market (U.S. Treasury) on the sidelines as well as some small holdings in a fully hedged position.