Reader Jim had this to say about my various recent posts and updates:

Reader Jim had this to say about my various recent posts and updates:

OK – I buy everything your saying.

I got out the second time the Dow hit 14,000 so I’m a happy camper since I’m 67 years old and in the capital preservation mode.

However, I have always had about 30% of my money moving around in self directed investments but only mutual funds for the past 5-6 years.

I know market timing is not a good plan, but sitting here on the sidelines while the Dow has fallen 20% after I got out tells me I should get back in but I have no idea when to do it. I’m thinking now that it’s under 11,000.

Question:

1. When do I get back in

2. What do I buy?

– an index fund?

– diversified number of mutual funds?

3. Any specific recommendations?

It’s amazing to me how many investors have the urge to get back in the market or feel the need to do some something even if being on the sidelines is the wisest course of action.

I think this need stems from the overwhelming desire to pick a bottom and hoping to ride a market rebound all the way to the top. Fat chance! While your odds of this “buying on dips” may work from time to time in a bull market, it can be financially deadly if you apply this idea in a bear market.

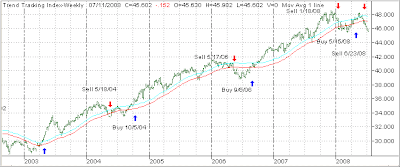

The best you can hope for, when following trends, is that you re-enter the market somewhere within 10% after a bottom has been formed. Remember, a bottom can’t be identified until it has actually occurred and prices are heading back up. Looking in the rearview mirror, you can then observe the turn around. That is exactly what happened at the end of 2002 and into 2003, before bullish tendencies continued.

Trying to pick an interim bottom because the Dow dropped a few thousand points is just nothing but a wild guess.

For me, to get back in on the long side of the market requires the domestic Trend Tracking Index (TTI) to cross back above its long-trend line. Currently the TTI is 2.95% away from that point.

Once that point is reached, we can subsequently identify, via our StatSheet, those domestic mutual funds and ETFs that are showing good upward momentum. We can then allocate accordingly. Trying to make that assessment now, while in the midst of a bear market, is simply an exercise in futility. That’s like someone asking you now what you will have for dinner next Christmas eve.

Try to control your itch wanting you to jump in on the long side of the market and instead let the trends be your guide. While you will have an occasional whip-saw to deal with, following them systematically keeps you at least from doing something you might regret later on.