The WSJ featured an interesting story with the intriguing title “An Experiment Shows The Risk Of Shorting.” Let’s listen in:

The WSJ featured an interesting story with the intriguing title “An Experiment Shows The Risk Of Shorting.” Let’s listen in:

Back in late October, with stocks rallying, I decided to hedge some of my exposure by buying a “short” exchange-traded fund—an ETF designed to rise when the market falls. At the time, based on historical norms, the market was overdue for a correction.

After all, stocks had gone up nearly 57% without any correction of 10% or more since March, despite a sluggish recovery and rising unemployment. So I bought shares in the ProShares UltraShort S&P; 500 fund, which aims to double the inverse return of the Standard & Poor’s 500-stock index. In other words, for any given day, if the S&P; 500 fell 10%, this ETF would be expected to gain 20%. I wrote then, “I’m deliberately calling this an experiment, not a recommendation. I suggest that conservative investors let me be the guinea pig.”

The guinea pig is back with his report.

It’s long been my policy to avoid bets on short-term moves in the stock market. There are good reasons for this. No one else has been able to predict the market’s short-term direction with any consistency, so why should I? I only expected to hold the short ETF until a correction materialized, then sell.

And indeed, despite my expectations for a correction, none came. On Oct. 27 the S&P; 500 was at 1063; by Christmas it was 1126, a gain of 63, or 6%. My ETF, as expected, went the other way and lost more than twice that much, or 13%. So, as I reported on Dec. 23, I figured the market was even more ripe for a correction. I bought the ProShares UltraShort QQQ fund, which aims to achieve twice the inverse return of the Nasdaq 100 for a single day. At that point, the Nasdaq Composite was at 2253. Still, the market kept rising; the Nasdaq hit 2320 on Jan. 19.

Then I was vindicated—somewhat. By Feb. 5, the Nasdaq Composite had dropped as low as 2100 intraday, or just under 7% below its level when I bought the short ETF. The Nasdaq 100 had fallen similarly. I was looking at a gain of over 8% in my UltraShort QQQ shares. Coincidentally, the S&P; 500 fell to 1063 the previous day, right where it had been when I bought the UltraShort S&P; 500.

But then what? I hadn’t developed a clear-cut exit strategy. I had the idea I’d sell the short funds when the Nasdaq Composite had dropped 10%, a standard correction. But it never quite hit that threshold. Still, I no longer had the sense that stocks were so overvalued. Much had changed since October. Corporate earnings were rolling in, and they were strong. Multiple indicators suggested the economy was indeed improving. Despite the decline, the market seemed remarkably resilient considering all the bad news, such as worries about Greece defaulting. And then, the markets resumed their climb. Last week the S&P; 500 was back to 1076 and the Nasdaq to 2184.

I bailed out, a modest gain in my UltraShort QQQ shares offsetting a small loss in the UltraShort S&P; 500. With transaction costs, I pretty much came out where I would have been had I held cash.

The short ETFs performed as advertised, but I doubt I’ll be buying them again anytime soon. It may turn out I sold them prematurely, and that the long-awaited correction of more than 10% is just around the corner. But who knows?

The problem with selling short—which is really just the problem of selling, magnified—is you have to be right twice. You have to know when the market is overvalued, and then you have to know when a correction has run its course. I know there are many successful short sellers, but I don’t like those odds.

It’s obvious that the idea was to simply experiment with no clearly defined entry and exit points, so for that I appreciate the author being the guinea pig.

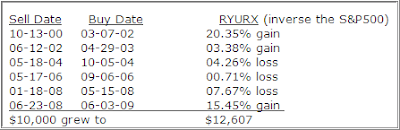

However, it brings up an interesting question, which has been asked by readers many times. How about selling short when the domestic TTI (Trend Tracking Index) crosses its long-term trend line to the downside and into bear market territory?

If you are an aggressive investor, you can allocate a portion of your portfolio to this approach. I found that there is a world of difference in looking at a chart with the benefit of hindsight and acknowledging that this point would have been a good one to short and actually implementing such a discipline.

What the chart does not tell you is the incredible volatility that you may have to face when taking a short position in bear market territory. Several readers shared their experiences with me back in 2008 when the bear struck and they went short. Violent market swings in both directions made that an endeavor for only the gutsiest of investors.

Nevertheless, I liked the author’s willingness to share the good with the bad, and it gave me the idea to do the same. My plan is that, once the domestic TTI breaks below its long term trend line and moves into bear market territory, I will take a position in SH (only for my personal account) and share my experiences with you.

To me, it’s not a question if we get to the bear market territory but only when.