Al Thomas, author of the book “If It Doesn’t Go Up, Don’t Buy It!” wrote in his weekly syndicated column about the “Attention Deficit Research Disorder.” Let’s listen in:

Al Thomas, author of the book “If It Doesn’t Go Up, Don’t Buy It!” wrote in his weekly syndicated column about the “Attention Deficit Research Disorder.” Let’s listen in:

Wall Street has everyone, even the “experts”, believing the myth that research is required to be a successful investor.

Every fact about a company must be known before an investment is made. Find out the P/E ratio, management, cash flow, product quality, market share, etc., etc.

All the figures show the company is a “good” company, but that does not mean the stock will go up. Historical studies show there is little correlation between being “good” and the stock price going up.

After the investor has done his analysis he comes to realize all this information is an agglomeration of stuff that has no wisdom. Suppose you memorized the Encyclopedia Britannica. Would that make you wise? No. You just know lots of “stuff”. The key is you have to know what to do with it, how to apply it.

I make my income from trading. Would it help me to memorize the Morning Star Manual? Not really. It won’t tell me which stocks will go up. If all this “research information” is so valuable why aren’t all brokers rich? As a former brokerage company owner, I will tell you they are not.

Today there is so much information available it is staggering. Then you have to know if what has been found is true. Look at all the false material the financial wizards have been feeding the public.

Furthermore information travels at the speed of light through the Internet to any person who cares to read it. It is very difficult to keep a secret. There are whistle blowers everywhere, not that they are bad people.

Wall Street brokerage companies want you to do nonsense research so you won’t sue them when their “recommendations” turn out to be wrong.

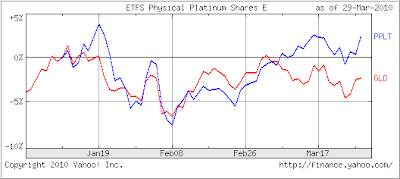

There is only one thing you really need to know and that is the recent direction of the price movement of the stock. Is it going up, down or sideways? Look at a chart of the stock price for the last year or so. On the Internet you will find a chart and it will tell you more in 30 seconds than 30 days of intensive research.

The inundation of facts and figures can have the investor a nervous wreck. There is no need for emotional tribulation when you look at the price movement of the “good” company’s stock. It will be apparent whether it is good, bad or indifferent. If the trend is up, buy it. That is all any investor needs to know.

When it turns down sell it. Find another “good” company whose stock price is appreciating.

Financial research is worthless. If it created wisdom everyone would be rich.

While Al’s viewpoint certainly goes against popular thinking, I have to agree with him based on my experience. Fundamental analysis as it’s called may be able to tell you whether one company is financially in a better situation than another one, but it does not tell you whether it’s a good time to buy.

Say, you had spent weeks of research to evaluate a stock (or mutual fund) to the point that you were suffering from data overload, but you finally decided to make a purchase—in the summer of 2008. The market crash was about to instill some reality on Wall Street, and your carefully selected investment went down the tubes along with everyone else’s.

The point is that most research makes for an interesting conversation at a cocktail party while adding some aura to the person who can best throw around some terminology that others do not understand. It does nothing to provide you with a market entry point, nor will it assist you in getting out before the bear strikes again.

Follow the trends and stay on the “right” side of the market and employ a sell stop discipline no matter what you invest in. Keep your ego out of the way by acknowledging the fact that there is no shame in taking small losses from time to time, because they will keep you on the right track by providing a safety net that will prevent you from participating in market disasters.