- Moving the market

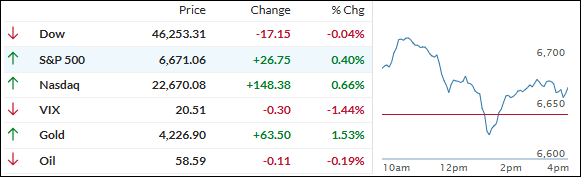

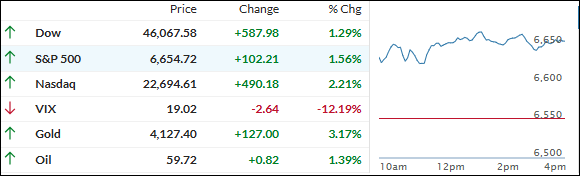

Stocks jumped out of the gate early on, fueled by upbeat bank earnings and optimistic forecasts from tech heavyweights that briefly pushed trade-war worries to the back burner.

Big Tech helped keep the early rally alive—Nvidia gained 1.2%, while Broadcom rose another 2% after Taiwan Semiconductor lifted its 2025 revenue outlook to mid-30% growth and reaffirmed plans for $42 billion in capital spending before year-end.

Momentum from earlier in the week carried over, thanks to strong reports from Goldman Sachs, Wells Fargo, and other big banks, which bolstered confidence in corporate fundamentals.

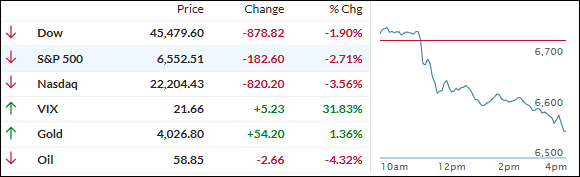

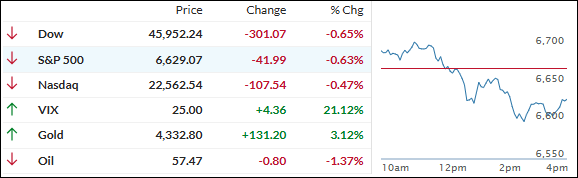

But as we’ve seen repeatedly this month, the early optimism didn’t last. Weak macro data, hawkish Fed comments, and fresh concerns over loan troubles at regional banks sapped enthusiasm by midday, with the major indexes turning south and surrendering Wednesday’s gains.

The latest hit to sentiment came from two regional lenders—Zions and Western Alliance—which revealed potential loan irregularities involving alleged fraud. That renewed fears about credit quality and financial stability, sparking a flight to safety.

Bonds rallied, driving the 10-year Treasury yield below 4% for the first time in a year. The dollar slipped, gold soared 3.2% to another record, and silver climbed 1.7% to crack the $54 level. Bitcoin, meanwhile, slid to $107,000 before finding some support.

With the market now juggling upbeat earnings, banking worries, and shifting Fed signals, is this just a healthy reset—or the start of deeper caution setting in before year-end?

Read More