Recently, MarketWatch featured several negative stories about gold as an investment. Here are some positive thoughts in “King gold keeps a steely grip over its subjects:”

Recently, MarketWatch featured several negative stories about gold as an investment. Here are some positive thoughts in “King gold keeps a steely grip over its subjects:”

Gold has a place in anyone’s financial plan. It’s a proven insurance policy, and nowadays could even be a lucrative speculation.

What gold is not is an investment, at least in the traditional sense. Gold is not an asset that can be analyzed to determine a potential future value. If I buy a stock, I own a share of that company. A bond is an obligation. Real estate provides potential for income — and all of these can be studied and scrutinized.

Gold is a bad investment precisely because it does not fulfill that role in a portfolio. Instead, gold is one of two things: an insurance policy to mitigate portfolio risk and to provide a cushion if everything else is turning to dust, or a speculation.

Now, gold may be a good speculation that makes buyers money. After all, it doesn’t appear that gold is in a bubble, like real estate or Internet stocks were. Still, you need to call it what it is.

Why? Because speculation is a polite term for taking a flyer, and investors should be honest with themselves. But people want to feel they have control over their bets. They pretend that speculation is an investment — a reasoned play with an above-average margin of safety. “It’s different this time,” they claim. Of course, it never is.

So it is with gold, and then some. Indeed, even making the distinction between investment, insurance and speculation rankles many gold owners. Let someone question not that gold belongs in a portfolio, but only where it belongs and how it should be used, and gold zealots head to the ramparts to defend their hoard.

No surprise there; King Gold has long commanded fierce loyalty from its subjects and kept them in its steely grip. The late financial historian and author Peter Bernstein knew a great deal about gold’s appeal. His compelling 2000 book “The Power of Gold” was aptly subtitled “The History of an Obsession.”

Bernstein also knew a lot about portfolio allocation and investor behavior, and was a staunch advocate of the power of diversification. Were he alive today, Bernstein likely wouldn’t be surprised by gold’s star wattage and would probably recommend keeping a smattering of gold in your portfolio — though at these prices you’ll want to add exposure on dips and over time.

“A small position is a hedge against everything hitting the fan,” Bernstein said about gold in a 2007 MarketWatch interview. “Nothing else quite serves that purpose as well.”

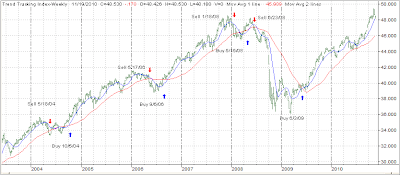

I never thought much of gold as an investment during the inflationary 80s and 90s when its price essentially went nowhere. The brief exception was late in 1987 when it peaked at $500, a level which it did not reach again until 2005. Take a look at this historic chart, which was too large to reproduce on the blog.

During the past decade, gold has been in a strong uptrend interrupted by sharp corrections, which at times reached 25%. Investors have historically connected gold with a hedge against inflation, which certainly has not turned out that way.

To me, gold is a hedge against uncertainty, which is why it has performed so well during the past year. Currently, I don’t use it as a speculative tool, but as part of a portfolio. As such, it can balance out market fluctuations similar to the effects that bonds have.

Case in point is the drubbing the markets took during the May/June 2010 period when the S&P; 500 lost -13.14%.

During the same time, a portfolio, including my currently preferred mix of bonds, equities, gold and country ETFs, declined by less than 2%. While this certainly will not happen every time the market sneezes, I believe it will reduce volatility and add stability especially during these uncertain economic times.

Whether you buy gold as an outright position via GLD, or more indirectly via a fund like PRPFX, it can at times keep your portfolio in better balance when the markets correct.

This improved stability is very important if you are using trend tracking as your investment methodology and are working with trailing sell stops, as it can avoid a whipsaw signal here and there.

Whipsaws are a necessary evil of using any exit strategy. If, with proper allocation, we can just avoid one here and there, this will have been a worthwhile and money saving effort.

Disclosure: Holdings in PRPFX and GLD