As the markets have ratcheted higher over the past few months, I have repeatedly commented about investor complacency setting in.

As the markets have ratcheted higher over the past few months, I have repeatedly commented about investor complacency setting in.

Some of the feedback I received even had a touch of arrogance as some seem to have thrown caution to the wind by jumping aboard of only the fastest moving ETFs.

Reader Steve had his experiences and shared the following thoughts:

Thanks for encouraging us readers to stay sharp during this time of market peaks. I for one am not complacent at all. I took charge of my investing last Oct. (was going through a broker for 10 years before that) and am trying to catch up for some lost months last year.

I have invested in some of the more volatile ETF’s in order to try to make a bigger return, and this keeps me paying close attention. I was invested in BRF and a couple other Emerg. Mkts., but got out a bit before you did as I hit my stops. I have been working at improving my fund selection by downloading Google finance data and calculating the MaxDD% you write about. It seems to be helping me choose ETFs that are in the upper echelon of your M-Index ratings, but with lesser volatility.

Too early to tell if my selections are getting better, but at least I am more informed about them. The present market conditions seem to make it a bit difficult to find performing ETF’s that have less than a 7-10% MaxDD%. Though this is more of a job than I thought it would be, I am learning.

I have been reading Karl Denniger (Market-ticker.org), and I like the mathematical approach he takes to analyzing the current market and economy. He has me convinced that a big haircut is coming. I am hoping that the downswing is not so rapid that it wipes out my modest gains before I can act on my stops.

Ideally, I’d like to get to a 10% unrealized gain, and then drop into a more conservative profile. I hope I get the time to do so before the markets reflect the reality that the economy is not that great. In any event, my stops are set and current, and I’m ready to bail if need be.

Thanks for your words of wisdom.

I agree with Steve that a severe haircut is coming; the timing of it is the unknown. It therefore is wise to be invested in a mix of ETFs, including those that are not the highest ranked ones in the M-Index food chain. The higher the ranking, the greater the volatility when a pullback occurs.

Slower and consistent growth, with limited whipsaws signals and a bear market avoidance approach, will beat fast growth over a longer term, such as five years, anytime.

Steve is talking about my MaxDD% indicator (Maximum DrawDown), which is not featured in the weekly StatSheet. This indicator allows you to select and hone in at those ETFs that have displayed less volatility during a given period, usually the past year.

It is very cumbersome to calculate this by hand, and I am looking for ways to include this important tool at some time in future StatSheets.

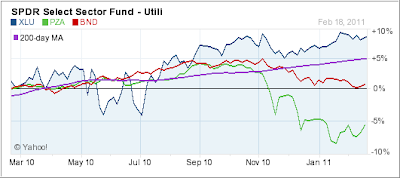

The goal of MaxDD% is to find ETFs/funds that have shown resistance to sell offs in the recent past by not having triggered their trailing sell stops. Even during the sharp pullback during May/June 2010, during which the S&P; 500 lost 16%, there were very few ETFs/Funds that bucked the trend.

One fund that stood out during that period, as it has many times before, was PRPFX, which we own. It came off its high by only -5.68%, for the period ranging from 12/31/09 to 2/18/11. Not only did it show above average resistance to sell offs, it also performed well when the market moved back into rally mode.

Out of the over 1,200 ETFs/No Load Funds I track, there was not one ETF that came close to this balance of upside potential with limited downside risk, while I found maybe 5 no load funds that were similar. Their MaxDD% was less than 7%; however, the upside potential was limited.

My point here is that at these lofty market levels, you need to have more balance in your portfolio to withstand some of the market’s hiccups. It pays to have exposure to ETFs/funds that have the potential to limit whipsaw signals during those market pullbacks that end up turning out to be temporary in nature.