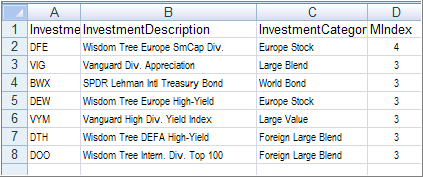

Something that’s been bugging me for a long time is the fact that I have only been able to publish the weekly StatSheet data in PDF format.

Over the past weekend, I finally figured out a way to extract the numbers for use in a spreadsheet. As a result, starting with this week’s publication, you will now have access to both, the PDF and spreadsheet version.

If you are afflicted with the number crunching disease, this could very well create feelings of irrational exuberance. Be that as it may, I know that this will help you in your efforts to better evaluate the numbers presented, and I am glad I finally found a way to resolve this long-term issue.

Hope you find it of value.