ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/03/weekly-statsheet-for-the-etfno-load-fund-tracker-2/

————————————————————

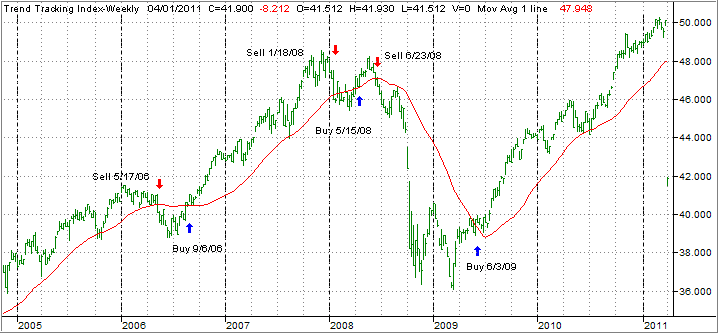

Market Commentary

Friday, April 1, 2011

ETFs RALLY INTO APRIL

Even though the major market ETFs closed out the month of March on a whimper, upward momentum shifted into high gear early in the morning of April 1st.

Providing the ammunition for this up move were the widely anticipated unemployment numbers, which came in better than expected. The Labor Department reported that the unemployment rate fell to 8.8% in March, while payroll employment increased by 216,000.

While that is a decent number, it’s finally a move in the right direction provided this tendency remains. However, what was not said is just as important. While investors cheered the report, below the surface lurk some potential troubles.