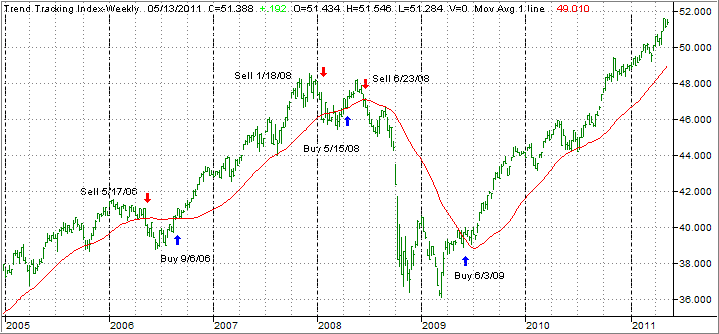

A big tip of the hat goes to reader Richard for sharing his back testing results of the Ivy ETF Portfolio. Richard is a far better chartist than I am and has thrown me an assist on some occasions. He writes as follows:

There are several details to be aware of, as I tried to keep it simple/rule-based:

1. No sell stops used – only 195dma on each asset class.

2. IVY chart starts on 4/10/07 because that was the inception date of BND.

(Could go back further with substitute funds, but this was a quick first cut.)

2. For the 195dma Buy/Sell trigger, I tried to simulate your real world monitoring of the 195dma buy/sell. To avoid short-term daily whipsaws as the index first goes through the 195dma, I set it up so the Sell was triggered only when the ETF makes 10 consecutive closes below the 195 dma, and likewise the re-entry; Buy after 10 consecutive closes above the 195 dma.

At first this seems too risky, but I looked at market cycles going back many years, and as the index meanders +/- around the 195 dma, this still catches the major trend and often better than a quicker move, and greatly reduces whip saw transactions and filters out some noise. I can adjust this to any # – and really in practice look at other factors also.

Let’s look at the chart: