ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

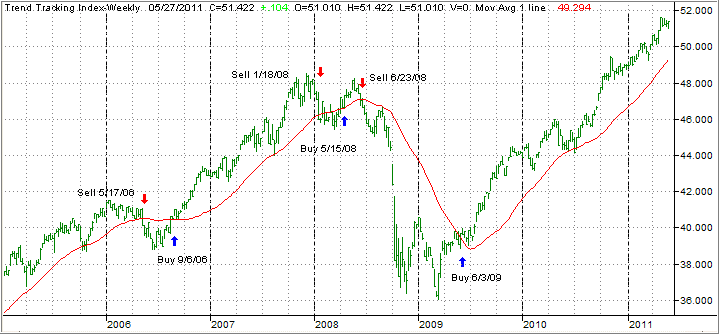

Market Commentary

Friday, May 27, 2011

AGAINST THE WIND

It was a repeat performance of the prior week, as the markets started out to the downside on Monday and spent the last four trading days trying to climb back. In the case of the S&P 500, it was aimless meandering within a narrow trading range as the index ended up giving back 2 points.

The entire month, the major indexes have been tiptoeing on a balance beam, and it appeared that at anytime the downside could come into play big time. It did not happen yet, but even Dr. Doom, Nouriel Roubini, chimed in with a similar tune in “Stocks teetering on ‘tipping point’ of correction.”