ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, June 3, 2011

WHERE’S THE DEADCAT BOUNCE?

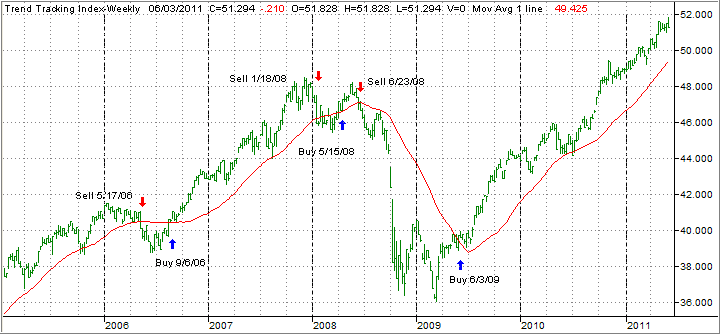

We left the month of May on a high note and, only one day later, stumbled into the month of June with the major indexes plunging to their lowest levels since last summer. The weak ADP report was the main culprit and forced economists to hastily revise their payroll growth estimates.

Other economic reports lacked positives and combined forces by leaving the market in the dust, as I posted on Tuesday. Usually, a sharp sell-off is followed by a bounce, but that did not happen, very likely in anticipation of Friday’s uncertain jobs report.

While the markets held fairly steady on Thursday, a rebound never materialized. Today’s jobs numbers showed that the economy has hit “a brick wall,” as one analyst put it. In light of the fact that only 54,000 new jobs were created, and the unemployment rate inched up to 9.1%, it was no surprise to see the major indexes head straight down at the opening.