ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, July 29, 2011

HOW LOW CAN YOU GO?

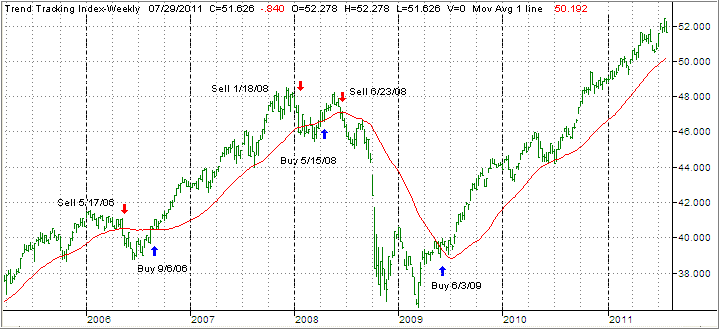

The major market ETFs took it on the chin this week, as continued indecision and confusion about the debt ceiling debacle put traders in a selling mood.

It was straight downhill for five days in a row, which brings up the question as to where support might kick in to stop the bleeding. As far as the S&P 500 is concerned, we have broken through the 50-day moving average by -1.47% and are honing in on the index’s 200-day moving average, which stands at 1,281. Actually, we came close to that level today, and it acted as springboard.

Whether this number will hold is wide open and will depend on further economic news along with a solution to the debt ceiling issue. Obviously, this has been the most talked about topic, and questions abound as to what will happen if the government actually defaults.