ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, August 19, 2011

FORECLOSING ON EQUITIES

The bullish start to this week has long been forgotten, as the major market ETFs got clobbered at the tune of -4.66% for the S&P 500. For the month, this widely followed index is now down by a mind boggling -13.00%, while our core holding, PRPFX, managed to slip only by a scant -1.43%.

Recession fears gripped Wall Street, and rightfully so, as stocks plunged sharply on Thursday, which was followed up by more bearish superiority on Friday. Domestic economic data showed a stalling economy, not just here but in Europe’s main engine, Germany, as well. The debt crisis is far from being contained and worries persist that primarily European banks will be adversely affected once the first domino starts to tumble.

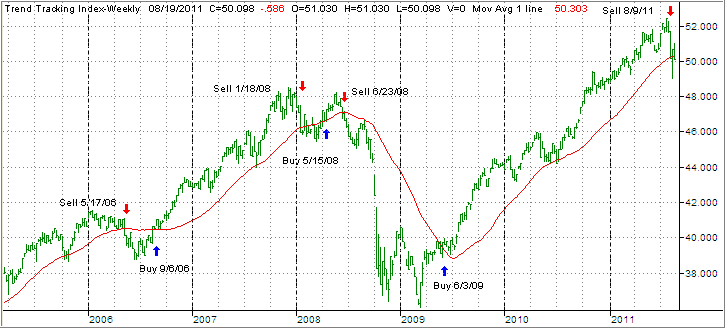

Our Domestic Trend Tracking Indexes (TTIs) slithered further south and have reached the following positions below their long-term trend lines: