- Moving the market

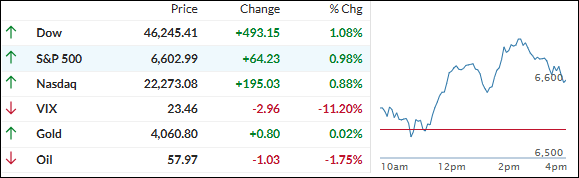

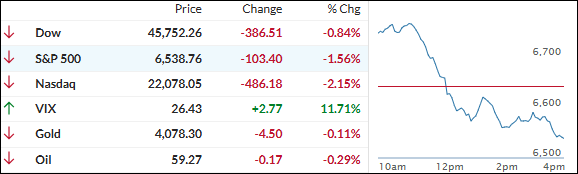

The day started wobbly—Nasdaq was down early after a report that Meta might drop billions on Google’s custom AI chips instead of Nvidia’s (Nvidia promptly got smacked -5%, Alphabet +1%, classic zero-sum AI drama).

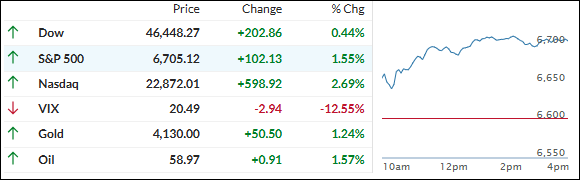

But the afternoon turned into a full-on comeback: everything flipped green, and we closed with solid gains across the board.

The bounce was legit broad this time—Mag 7 lagged while the other 493 S&P names and small caps stole the show (short squeeze helped there too).

Macro data was straight-up ugly—weak ADP jobs, trash retail sales, cooling housing, lousy consumer confidence—but in this market, “bad news = good news” because it cranks December rate-cut odds even higher (now north of 80% after John Williams’ dovish comments Friday).

That sent the 10-year yield below 4%, the dollar lower, and gave stocks the perfect excuse to rally.

Bitcoin slipped a bit, gold teased $4,160 then chilled—funny how gold feels rock-solid on liquidity while BTC’s acting like the nervous cousin right now.

With ugly data juicing rate-cut hopes and breadth finally showing up, could this be the spark for a legit year-end melt-up, or does the “sell the news” vibe still feel stronger?

Read More